- The Economy Tracker

- Posts

- 2026 Came in HOT!!!

2026 Came in HOT!!!

This could change everything.

What. A. Week. 🤯

We are not even two weeks into the new year, and it already feels like an entire quarter has passed.

I had planned to send out the 2026 Forecast this morning. It is written and only needs final formatting. But the new year has arrived with an unexpected ferocity, and what is unfolding right now demands attention. The economy is not separate from this moment. It is part of a much larger story, one that will carry significant implications in the months and years ahead.

I expected some major geopolitical developments within the first two to three months of 2026. Events capable of reshaping history and altering the global balance of power. However, I did not expect them to begin immediately, or with this level of intensity. As someone who has always been intensely interested in markets, economics, world and US history, and human behavior, watching the past week and a half unfold in real time has been extraordinary.

The only thing rivaling that momentum is the stock market, at least for those positioned correctly. Early returns have been exceptional, and, based on both technical and macro conditions, this environment can persist long enough to support well-structured medium-term trades.

Both of these will have major implications for the remainder of the year, which will have major consequences for decades.

We are standing at a critical inflection point for multiple long term patterns:

In human history, with geopolitical consequences that will echo for the next century.

Domestically, as the nation reconciles past grievances while laying foundations for decades ahead.

Secularly, in terms of long-cycle market structure.

Within the credit cycle, where transitions reshape capital flows and opportunity.

This is not speculation or rhetoric. History shows that there are moments when “decades happen in months.” The deeper and more things I research, the more clearly the data and historical parallels confirm that we are in one of those rare windows right now.

Does that mean the future can be predicted in precise terms? Of course not. That is not how markets or forecasting work. But the patterns are clear enough to identify what kinds of events to watch for, where pressure is building, and how to recognize structural change as it begins.

Case in point: Venezuela. Prior to the operation to get Maduro everyone said the US operation there was about drug smuggling. I made public comments outlining what was actually happening beneath the official narrative.

Oil didn’t launch higher, but we didn’t really hit Venezuela too hard either. Just went in, secured, and extracted their leader.

First part is about Sable Offshore and change in rhetoric around energy, but the highlighted part is what I want to point out here.

It was clear from the beginning that this was a strategic energy play. But not at all like the one where the US invaded Iraq in 2003.

This time is indeed different as the move to secure vital resources in our hemisphere is being forced upon us by a large and strengthening rival. China.

These flash points in history do not happen overnight. They simmer quietly for years, then multiple forces align and shift at once. These periods create some of the greatest opportunities in history. Not only for capital growth, but for personal advancement and long-term positioning. In markets, timing is everything. Acting when structural change begins can produce disproportionate results.

This is one of those moments.

But not just for markets or personal advancement. The same is true for politics, both domestic and geopolitical.

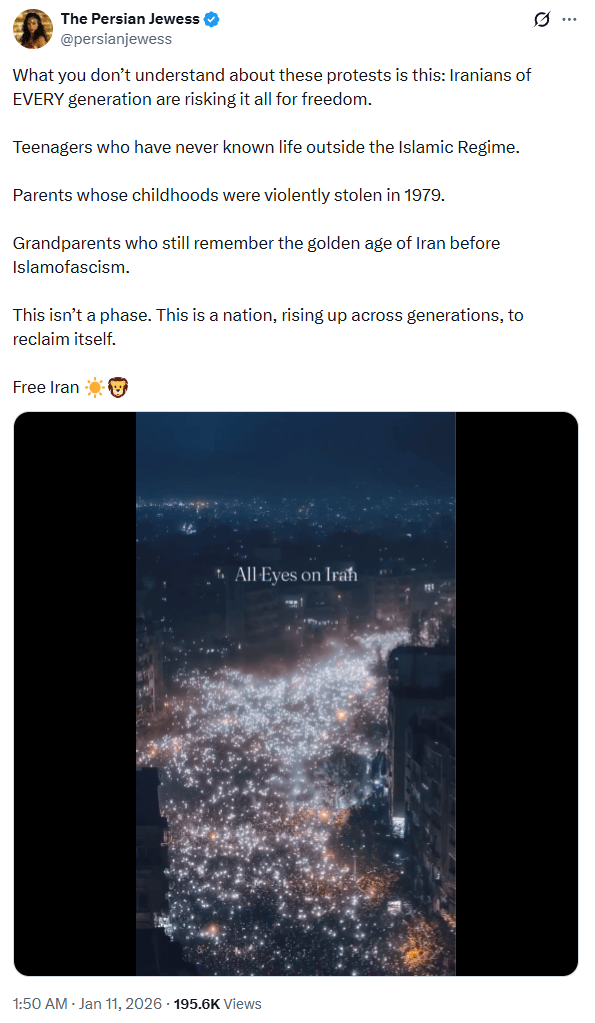

Look no further than what is currently transpiring in Iran as the population rises up to finally defeat an autocratic, brutal, torturous, and murderous regime which has held down the population and the country over 45 years.

This is a truly amazing positive turning point in the history of the world. It’s insane that the corporate media isn’t giving this moment the coverage it deserves.

Why This Matters to You, Your Life, and Your Portfolio

These compression points create some of the best opportunities for life-changing returns. Times when the same amount of work and effort can give much larger results than more typical times in history. While the masses are screaming at their screens and a few block traffic in the US, the real next generation of leaders is quietly shaping the world that will follow. Those who remain reactive become participants in a system built by others. Those who act deliberately help design what comes next and are the ones who actually improve their communities and change the world.

Over the coming weeks, I will outline:

what is happening beneath the surface,

how to participate intelligently, and

how we can track these developments in real time.

Timing is everything in markets and life. Right now, the timing is extraordinary. The early 2026 returns have been mind-blowing, and the setup suggests this continues for weeks to months.

The US Economic Picture Is Shifting

We’ve been tracking tracking the Economic Slowdown that began in Biden's final year here closely. Typically, recession follows. But I've also noted there are rare times when the economy could re-accelerate (like the 1990s) or skip a recession entirely and move directly into the next credit cycle.

New data that was delayed from the government shutdown now confirms a legitimate path for this scenario.

Does this include some political manipulation of economic data? Yes. As is often the case to some degree. That was true under the previous administrations and it remains true today. But alongside that reality, there are also genuine tailwinds developing. And the current administration is now using that momentum more effectively to support continued growth.

One example is the effort to ease mortgage rates by having Fannie Mae and Freddie Mac purchase longer-term bonds. If this helps revive the housing market, and if domestic shipping and logistics finally emerge from their prolonged industry recessions (as early data suggests may be happening) then the combined impact could be enough to keep the economy on a sustained growth path.

If that scenario plays out, it would represent a meaningful structural shift. It is a potential game-changer, and one I will examine in greater depth going forward.

What's also striking is that Trump is also getting lucky: an unusually warm winter is crushing already low natural gas prices and helping the inflation fight. Whether it’s luck, divine intervention, or climate change doesn’t matter.

Success breeds success. Should the housing and transportation industries enter Recovery, AI investments continue, and unemployment does not surge and/or stay around 5%, then those international investment "pledges" start converting to actual capital inflows, which boost the economy further.

Now entering the second year of Trump’s second term, the structure of his agenda is becoming clearer. I have been highly critical of his first year. That has not changed, as some of the actions and communication have been horrendous. But what I am seeing now, from a macroeconomic standpoint, is more coherent and more strategically executed than the communication out of the White House has suggested.

In essence, this is your “4D chess” narrative playing out… Should that indeed end up being the case.

Does that mean I retract my criticism from the past year? No. And for a variety of reasons.

With that being said: What I'm seeing now is incredibly impressive.

There is still a long way to go until mid-terms, but the policies, timing, and execution of this administration is exactly what was needed for Trump to once again pull a rabbit out of his hat this November. The sitting president’s party has lost ground in the House 20 of the past 22 midterms, going back to 1938. This is why it is vital for Trump and Co. to begin stacking wins throughout the year to beat history, and they are off to a great start.

A Note on Economic Literacy

What continues to concern me is how consistently the public continues to be misled on economic and financial issues. Once you truly understand how markets function, the sheer volume of misinformation becomes impossible to ignore. Worse, that misinformation is often used to extract money from people who lack the tools to evaluate what they are being told.

One of the primary reasons I share my work publicly is to expose that dynamic, and to challenge myths, bad-faith narratives, and those who profit from widespread financial illiteracy.

What frustrates me most is how financial misinformation gets weaponized against the public. This is especially true for right-wing audiences since 2008. Tell people "Obama is the devil," “Abolish the Fed,” and then say "housing and the economy will collapse again," and it appears that you've got a paying subscriber for life.

Exposing those frauds is one reason why I chose to share my work here.

In an ideal world, moments like this would trigger a broad push for financial education. But history is rarely ideal. When national security and long-term stability of the nation are at stake, difficult tradeoffs are often made. I may lean libertarian in philosophy, but when it comes to national defense, I defer to pragmatism. I will do so as long as their are rivals who are actively consolidating power and the resources required for conflict and influence. A fully free and fair system is an aspiration; allowing strategic adversaries to exploit vulnerabilities in the meantime is neither wise nor virtuous.

If incorrect and easily refuted economic messaging is currently being used to enhance U.S. safety and security interests (domestic and abroad), I can live with it for now. Time is limited and more valuable than usual at inflection points like this.

But this needs to be addressed in the not too distant future to create a stronger and more economically stable country.

I may lean libertarian, but national defense forces practical compromise. If you don't have conflicting views on complex topics, you're not thinking deeply enough about them.

What's Next

Some of what I’ve written here may raise questions. My goal over the coming weeks is to address them clearly, using evidence rather than rhetoric.

Things are moving at an unusually fast pace This is now true for the economy as well, which is typically slow and incremental.

Given the pace of change, I'll likely adjust my publishing cadence. More updates, smaller bites, faster turnaround.

A new project I’m undertaking will also take me back on the road in the coming months, traveling across the country. That on-the-ground exposure is invaluable when done right. It provides direct insight into how the economy is actually functioning, and how it is being felt by real businesses. Not just reported in data releases.

This kind of extensive travel is precisely what helped me connect the macroeconomic dots in the first place.

What you should know about everything I publish:

My opinions come from wanting the best outcomes for the most people

My forecasts and insights come from data, both historical and current

My trade setups come from wanting you to make serious money and live the life you dream of

This is a truly amazing time in the history of the world and our country. Don’t miss out or get caught up in the now outdated political machinations of yesteryear.

More soon.

Click the Leave a comment button if you have any questions or comments, or need something clarified. Don’t be shy. The main point here is to improve constantly. Questions and comments help us both and tells me what you are interested in learning/hearing more about.

If you enjoyed this post or found it useful, do me a favor and hit the like (heart button all the way back to the top of the post and to the left) and share it with others.

Reply