- The Economy Tracker

- Posts

- Here's the Deal

Here's the Deal

Weekly Economic and Market Report

The Fed Cuts Rates by 25bps.

As expected, the Federal Reserve cut the Fed Funds Rate by 25bps today, bringing the rate down to 4.00-4.25% from 4.25-4.5%.

In doing so they are showing which of their dual mandates they are protecting at the expense of the other. By cutting here while inflation is elevated and trending back up, the Fed is putting the priority of the labor market over the fight against inflation.

Fed Chairman Jerome Powell made the following points during the announcement and Q&A:

“Recent pace of job creation appears to be running below the breakeven rate.”

Job gains have slowed on lower immigration and participation.

Downside risks to unemployment appear to have risen, which is the reason for the cut.

Overall effect of tariffs on inflation remain to be seen.

It’s possible that the inflationary effects of tariffs could be more persistent, but that for now, the expectation is that they will represent a one time price increase and will be short lived. Stating that the Fed will ensure it stays temporary.

Inflation has risen recently and remains elevated.

Slower GDP growth is driven by weaker consumer spending.

The Fed’s goals are in tension as inflation risks are to the upside, while employment risks are to the downside.

“Tariffs have pushed up prices on goods.”

Speaking of Inflation: It Continues to Rear its Ugly Head

The good news last week was that we got a little reprieve from inflation in PPI:

PPI an Core PPI: 2011-Current

PPI: 36 month

While last month’s surprise PPI surge was driven by the increased costs associated with servicing tariffs, the problem is that PPI does not take imports into account when it comes to goods.

Actual | Expected | Previous | |

|---|---|---|---|

Core PPI (May) | -0.1% (MoM) 2.8% (YoY) | 0.3% (MoM) 3.5% (YoY) | 0.7% (MoM) (Revised lower from 0.9%) 3.7% (YoY) (Revised lower from 0.9%) |

PPI (May) | -0.1% (MoM) 2.6% (YoY) | 0.3% (MoM) 3.5% (YoY) | 0.7% (MoM)(Revised lower from 0.9%) 3.1% (YoY) (Revised lower from 3.3%) |

Core CPI (May) | 0.3% (MoM) 3.1% (YoY) | 0.3% (MoM) 3.1% (YoY) | 0.3% (MoM) 3.1% (YoY) |

CPI (May) | 0.4% (MoM) 2.9% (YoY) | 0.3% (MoM) 2.9% (YoY) | 0.2% (MoM) 2.7% (YoY) |

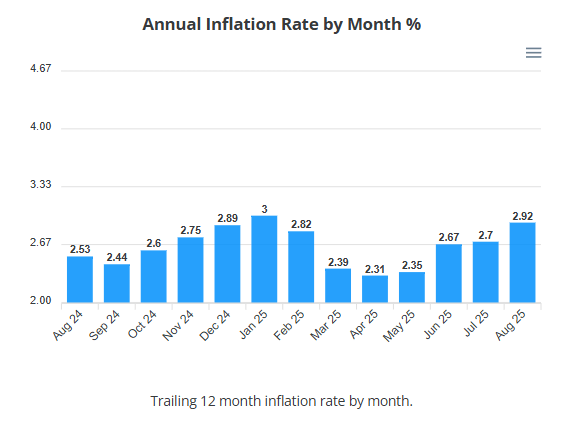

Which in turn puts the bigger spot light on CPI and PCE, and CPI continued to rise in August and is now trending back up on the monthly time-frame.

CPI and Core CPI: 2020-Current

CPI is also now higher every month since tariffs were first announced, and growing steadily since they began to take effect.

CPI: Last 12 months

Jerome Powell and President Trump may not agree, but I’d expect this trend to continue as Reciprocal Tariffs only went into effect in August. Today’s rate cut is in response to the deteriorating job market and political pressure from President Trump and his administration, and not because the battle against inflation has been won.

Unfortunately, cutting rates increases demand which puts more upward pressure on prices. Meaning this is a trend you will likely see continuing in the months ahead unless the wheels fall off of the economy and crush demand. Especially as reciprocal tariffs are now being implemented as well, adding additional costs to imports.

911K Fewer Jobs Created Apr 2024 - Mar 2025

Last week we found out that 911K (0.6% of total employment numbers) fewer jobs were created from Apr ‘24 - Mar ‘25.

This is the largest downward revision in terms of absolute number on record, and second highest in terms of a percentage of total employment. Second only to the 2009 revision at the depths of the Great Financial Crisis.

For those that read Two Centuries of Data, One Clear Lesson last week, you know that this is one of the signs of a deteriorating economy. And for longer-term subscribers here, that is exactly what we have been anticipating.

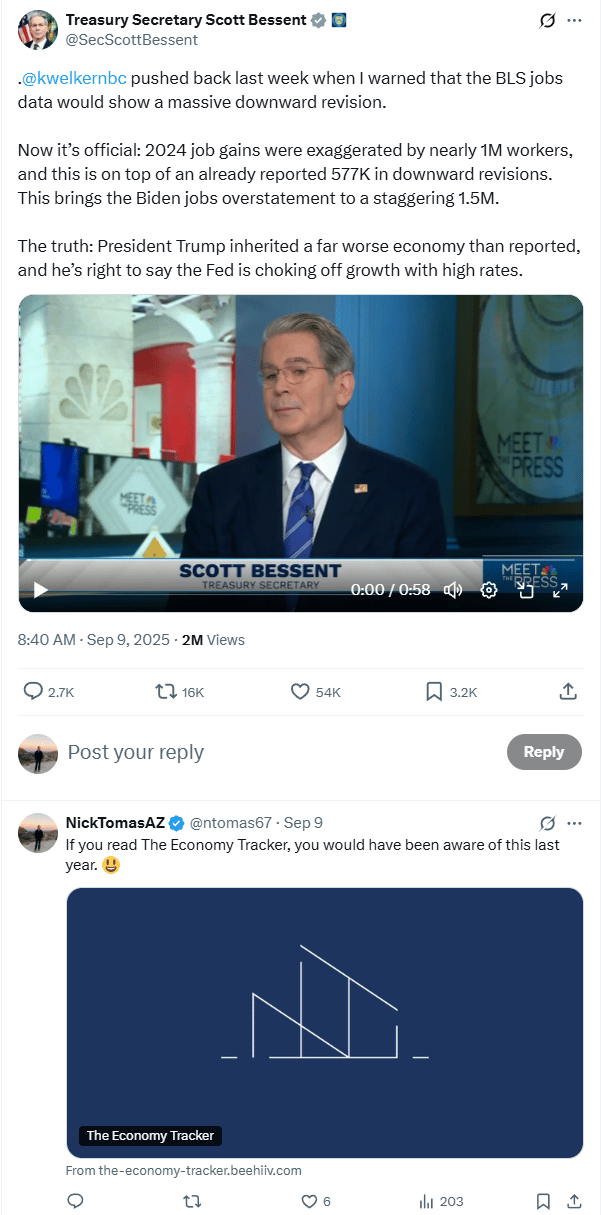

So while it may have been a surprise to the current administration that they were taking over during a deteriorating economy, it’s been known to us since last year. A fact I was happy to share with Scott Bessent and his followers last week 😃:

Except he’s wrong about the Fed choking off the economy. As readers here know, the Fed could have begun lowering rates at least two meetings ago if not for the inflationary effects of added costs due to tariffs.

This brings up a great teaching moment about stock markets and economic data:

People can complain that the lower employment numbers could have negatively affected the stock market the past year and a half all they want, but stocks are now higher than they were prior to the announcement of the revision. With the exception of a surging or collapsing unemployment rate, employment numbers can have a momentary impact on stocks, but it doesn’t control the market. There is no hard correlation of an employment number of X means X% move in markets. That sort of thing does not exist, as markets do not operate that way.

Can the initial employment numbers and revisions be spun in the news to make things seem better than they are and were? Of course.

Just like higher inflation ratios can be spun as “lower,” because they came in less than estimated.

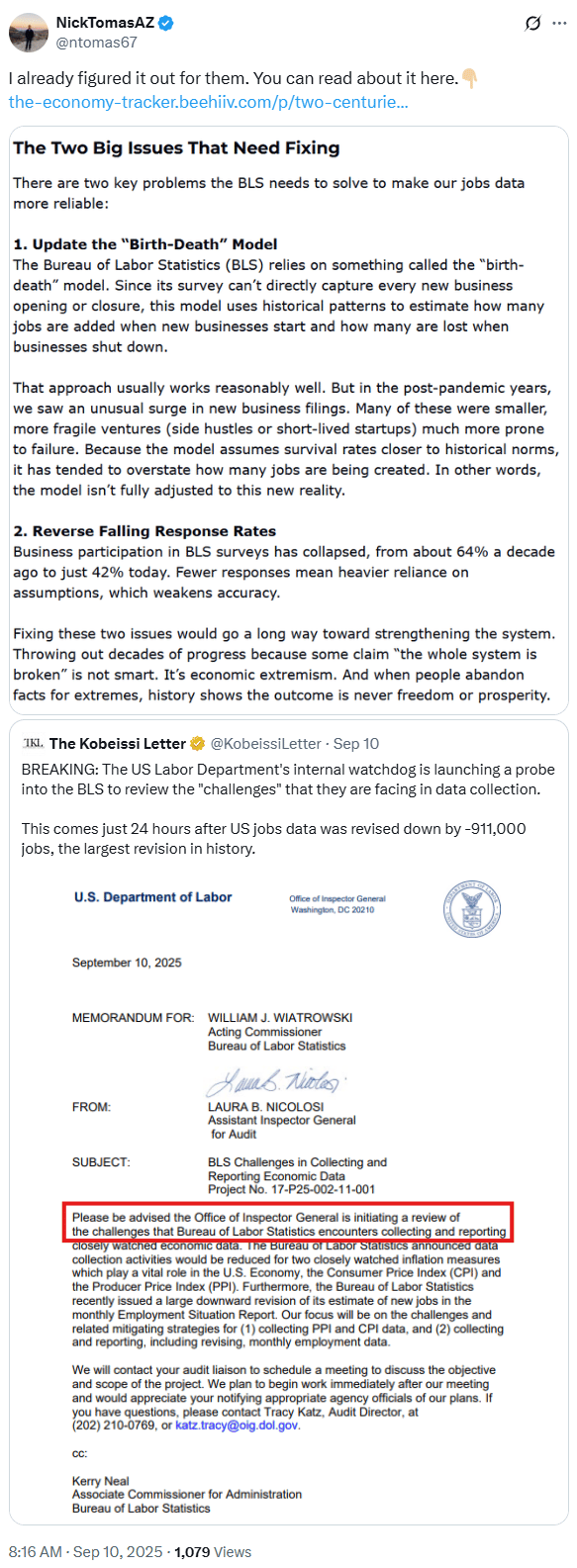

Proof that Department of Labor should be reading Here’s the Deal.

The Department of Labor announced last Wednesday that they are launching a probe into how the BLS data collection could have led to a 911K revision.

But subscribers here already know the answer as I answered that question in Centuries of Data, One Clear Lesson the day before.

Good news, bad news, subscribers. You’re much more informed and a few steps ahead of the federal government when it comes to the economy. 😃

Markets:

Markets continue to run hot, as they have since the tariff and Liberation Day lows in early April.

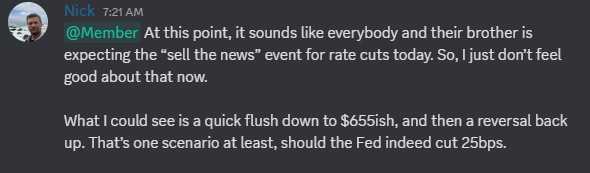

So hot, that it appeared everyone was thinking the same thing heading into today’s announcement. Which is why I re-thought my plan of action and let the trading group know a few hours before the announcement:

This ended up being exactly what happened.

SPY 5min chart for 9/17/25

Pretty cool when it works the way you drew it up.

But I am not convinced we are out of the woods yet for the month. Markets could still roll over here if SPY can’t stay above $660. If it can, then $664 looks to be in the cards.

I still expect some sort of a market correction before Oct/Nov to set up a run back to new highs into the end of the year.

With that being said, I will also be keeping an eye out for more data confirming that the economy’s deterioration is accelerating. The result of which could easily end the party for the current credit cycle.

Although, many stocks do look primed here and close to surging higher. It’s kind of insane how many choice set ups there are at the moment.

$SPY ( ▲ 0.5% ) S&P 500:

SPY Daily

$DIA ( ▲ 0.23% ) Dow Jones Industrial Average:

DIA Daily

$QQQ ( ▲ 0.75% ) Nasdaq:

QQQ Daily

$IWM ( ▲ 0.36% ) Russell 2000 (Small Caps):

IWM Daily

A very heavy and heartbreaking week.

What can one even say after a week like the one we just lived through?

To be honest, I still feel numb. Like many of you, I witnessed things last week I wish I had gone my whole life without seeing.

As we all know, I have harped much more on right here than I have the left. I do that because as I’ve mentioned in the past, I think it’s important to call out the deficiencies in ones own point of view if you are going to openly call out the others.

However, last Wednesday was surreal. Sadly, the assassination of Charlie Kirk and the reactions since are a reflection of one of the darker points in human behavior cycles which we currently find ourselves deep within.

There are endless opinions on this, and the discussion quickly became as ugly as it could get. When the rhetoric heats up, sometimes we need a little reminder of who we want to be and the ideals we want to live up to.

It reminds me of a scene in the Beastie Boys Story on AppleTV.

The way the remaining members of the group tell the story, when the Beastie Boys released their album, License to Ill, in 1986. “Fight for Your Right” was the first single released and it immediately took off. Here’s the thing though, they wrote “Fight for Your Right” as satire to make fun of the hair band/glam metal/frat-boy party scene that was prevalent at the time.

But then the song became a big hit, and specifically within the very culture that they were mocking. Which meant that the Beastie Boys found themselves on tour performing for and partying with the very group of people they were initially making fun of and did not want to be like. The result was that they eventually became the very type of people they were mocking and found abhorrent in the first place.

This happened because that scene and the behaviors within it became their main focus.

As Tony Robbins says, “Where focus goes, energy flows.”

When we fixate on the faults and repugnant behavior of others, it’s easy to overlook our own faults while we become blind to our own increasingly repugnant behavior.

Spend your time consumed by an annoying neighbor, and you’ll eventually turn into one yourself.

Focus on hating your opponents, and you’ll soon mirror that hate until it becomes your own.

Think the market will screw you, and you’ll see manipulation at every turn instead of your own mistakes which is typically the reason for big losses in the first place.

Partake in random acts of kindness, and maybe you’re the one who plants the seed for grace to flourish in your sphere of influence.

Dwell or focus on something for long enough, and you eventually become that thing. So, why not focus upon and work to be the way you wish the world to be?

Quote of the Week:

“I may not agree with what you say, but I will fight to my death for your right to say it.”

Click the Leave a comment button if you have any questions or comments, or need something clarified. Don’t be shy. The main point here is to improve constantly. Questions and comments help us both and tells me what you are interested in learning/hearing more about.

If you enjoyed this post or found it useful, do me a favor and hit the like (heart button all the way back to the top of the post and to the left) and share it with others.

Reply