- The Economy Tracker

- Posts

- Here's the Deal

Here's the Deal

October 4, 2025

Stocks Are Ripping Higher While the Economy Continues to Weaken

Look, I get it. It must sound insane when I say to expect stocks to soar while economic conditions deteriorate. Yet, here we are. That exact scenario is not only unfolding but intensifying as we enter the fourth quarter of 2025.

At first glance, it feels contradictory. How can markets boom while the economy deteriorates? But when you understand the cycles of markets, economies, and human behavior, it all makes sense. The cycles themselves are predictable. It’s navigating the human responses, the nuances, and the timing that make them tricky to maneuver skillfully.

What’s happening right now isn’t abnormal. In fact, many of us saw it coming well in advance. The challenge was not predicting if it would happen, but waiting for the clues to emerge in real time and adjusting along the way.

For those who don’t live inside markets every day, the good news is this: cycles actually become easier to navigate once you know what to look for. That’s why I’ve offered you ways to gradually make step-by-step adjustments since last year. Things like cutting an unneeded monthly expense like a barely used subscription each month and instead putting that into money into a rainy day fund so you wouldn’t be caught flat footed when the economy “suddenly” stalls out.

The day when the current credit cycle finally unravels is approaching. But it’s not here yet. What we have right now is a raging hot stock market, a melt-up phase where explosive opportunities are showing up almost everywhere you look. This is exactly what credit cycles tend to do at the tail end of a secular bull market.

That means two things:

Prepare financially – It’s past time to get your house in order for tougher days ahead. No, that doesn’t mean a 1930’s style depression, more like a a run of the mill recession where once seemingly secure jobs are no longer existent. Shore up the essentials, build buffers, and don’t leave loose ends.

Seize opportunities – Ironically, this is also a moment to take shorter and medium-term chances in the stock market. Done wisely, these opportunities can create the extra cushion you’ll need when conditions turn as long as you don’t overstay the welcome. Plus, markets like this tend to reward and gloss over novice level trading mistakes, and many times even reward them.

As I said a year ago, “Jump on my back, I’m going to guide you through the rest of this credit cycle and into the next.” That’s exactly what I’ve been doing. Navigating the shifts and helping you stay on course. The music is still playing loud and clear, but when I say it has stopped, don’t mistake that for me losing my edge and think it’s simply another opportunity to buy the dip. Our opinions and desires mean nothing to markets, so don’t get fooled into a false sense of security when it’s time to cut bait and run.

Some may not like what is currently transpiring in markets and the economy, but that is irrelevant. There is no prize for complaining about reality. Learn how cycles work. Understand them. Take part when the opportunities are most available and offer the most upside potential.

Because at this point in time, markets are as good as it gets. And this opportunity won’t last forever. When they do turn, you’ll be glad you prepared in advance.

Jobs Market Continues to Deteriorate.

Because of the government shutdown, we did not get the official jobs data from the Bureau of Labor Statistics (BLS) this week.

But that doesn’t mean we’re flying blind. We still have a few windows into the job market through reports from ADP, Challenger, and the latest hiring and job openings data that were released before the shutdown began on Wednesday morning.

The ADP private payrolls report revealed something surprising: U.S. employers once again shed 32,000 jobs in September 2025. This was the largest monthly decline in over two years.

Here are the key takeaways:

Small businesses were hit hardest, losing around 40,000 jobs.

Medium-sized businesses also posted declines.

Large firms (500+ employees) added about 33,000 jobs, which softened the overall loss.

By industry: education and health services added 33,000 jobs, but other key sectors such as leisure, hospitality, trade, and professional/business services all saw declines.

Normally, we’d be waiting for the official BLS jobs report to confirm or challenge these numbers. But with the shutdown, ADP’s report is now the market’s main snapshot of employment conditions for September.

This carries two big implications:

Markets and the Federal Reserve – A weakening job market increases the likelihood that the Fed continues to cut interest rates at its next meeting on October 29th. The central bank is watching closely, since stalling job creation signals slowing growth and rising uncertainty. However, unlike most cycles this is happening with an elevated rate of inflation that is back on the rise putting the Fed in a very difficult position of prioritizing one mandate over another.

Reliability of the data – Contrary to popular opinion, private enterprises such as ADP and Challenger, do not hold up as well as government data from BLS about the economy. This is why it is more important to pay attention to relative trends in each rather than the actual numbers. And they all show persistent weakness in the labor market. Multiple surveys saying the same thing makes this difficult to ignore.

The other pieces of labor market data tell the same story:

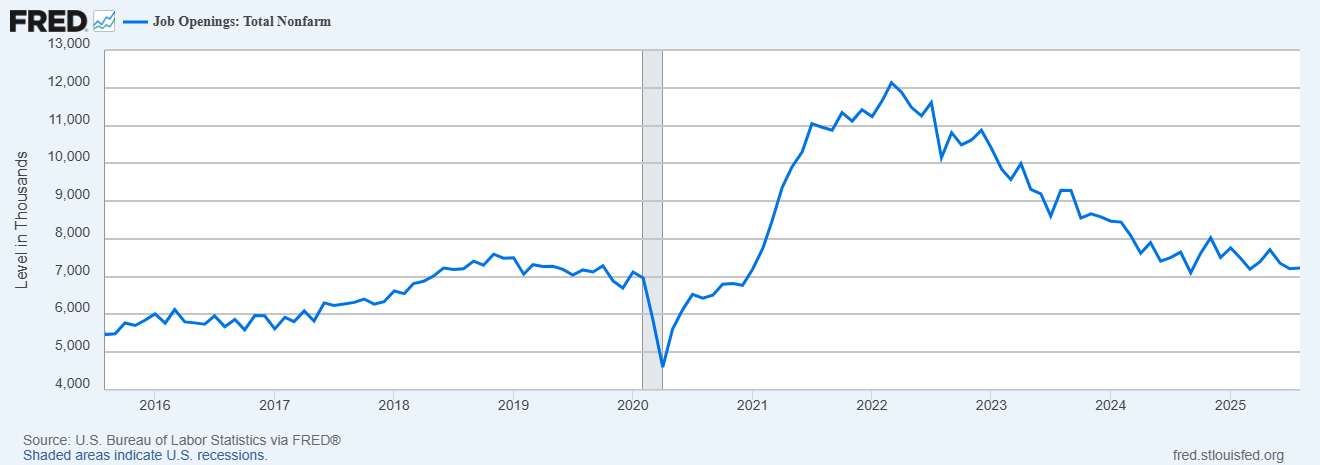

Job openings are back down to pre-pandemic levels—about 40% lower than the peak we saw during the Expansion phase of this cycle.

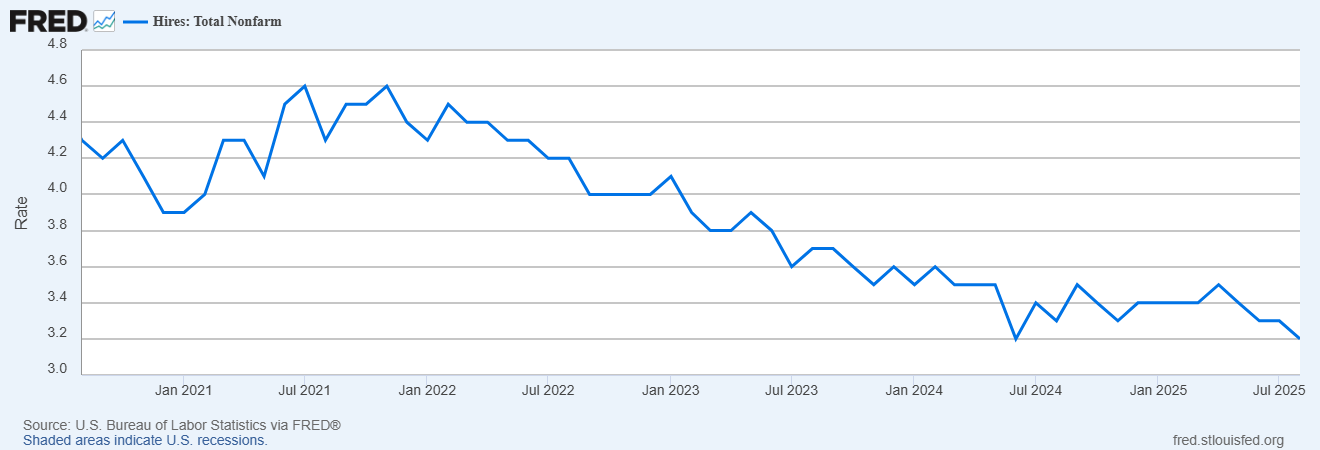

Hiring continues to trend downward, already sitting at the lowest point of the current cycle since hiring picked back up after the current credit cycle began in March 2020.

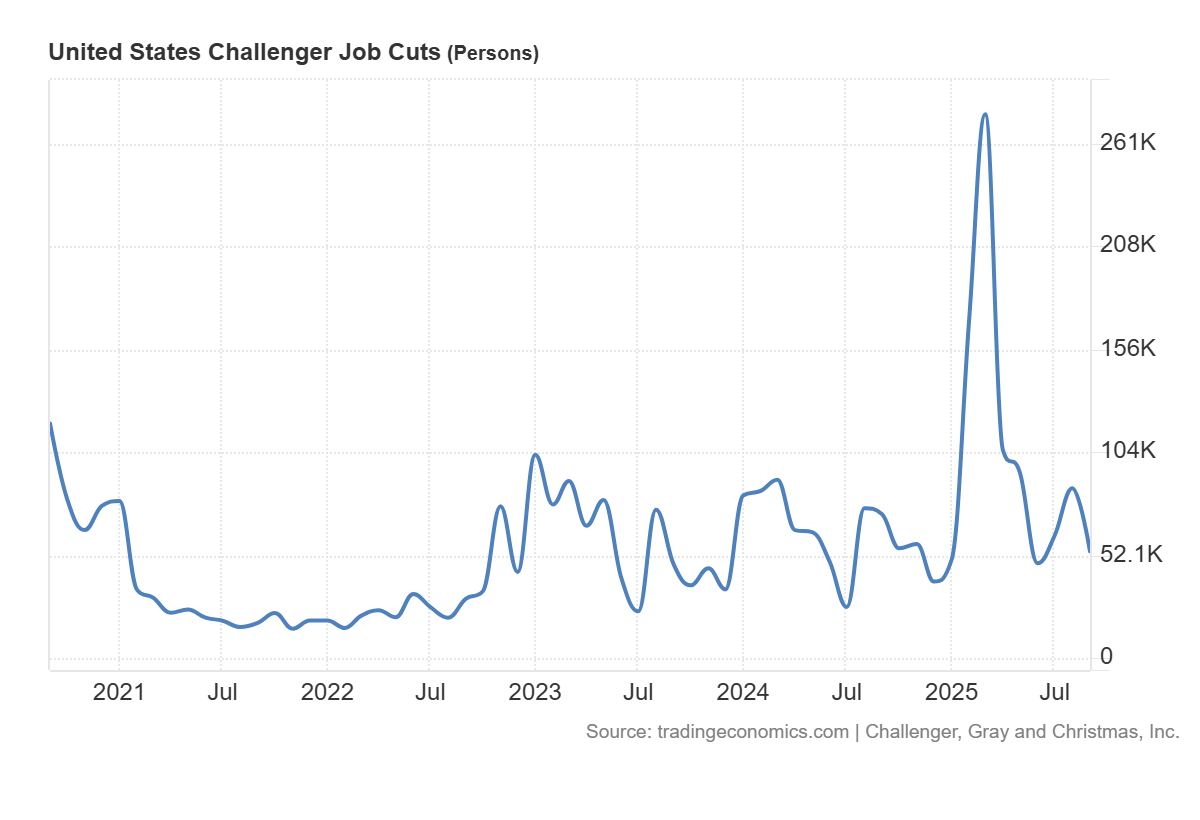

Job cuts, according to Challenger, remain elevated above the cycle’s average, following the sharp spike we saw in March of this year.

Put together, the evidence is clear: the U.S. job market is weakening, and the decline is becoming more pronounced. This is not unusual and is exactly what we tend to see in the late stages of a credit cycle, when businesses tighten up, job creation slows, and layoffs become more common.

E.J. Antoni Out of the Running to Lead the BLS

The White House officially withdrew the nomination of E.J. Antoni to lead the Bureau of Labor Statistics (BLS) this week. His withdrawal followed weeks of bipartisan criticism and public controversy over his background and online activity.

Including from yours truly in Two Centuries of Data, One Clear Lesson.

Several key issues undermined Antoni’s chances:

Lack of experience – His career was rooted primarily in partisan think-tank roles rather than in government service or statistical work. That raised red flags for many economists and lawmakers who correctly stressed that running the BLS requires deep technical and nonpartisan expertise.

Loss of Senate support – Early enthusiasm from some Republicans faded, and without strong backing, his confirmation prospects quickly dimmed.

Public and professional opposition – Economists, advocacy groups, and commentators from across the political spectrum argued for a nominee with proven statistical competence and a commitment to integrity.

The BLS plays a vital role in producing data that shapes policy, markets, and public understanding of the economy.

Antoni’s failed nomination reflects a broader concern shared by both parties: that it is imperative for the BLS to be led by someone whose qualifications and nonpartisan integrity are beyond question.

The administration has not yet named a replacement nominee. However, White House officials have indicated they will look within the nation’s statistical agencies or the Council of Economic Advisers for candidates. The priority now is to select someone with:

Technical expertise in economic statistics

A track record of nonpartisan work

Proven management experience

By leaning toward a professional insider rather than a partisan pick, the administration appears to be aiming to restore confidence in the BLS and ensure the agency continues its mission of delivering objective, reliable data.

As critical as I have been of the Trump Administration’s economic policies, this is a sigh of relief and I applaud them for making the change. While at the same time hoping that changes to their economic team doesn’t stop there and three others are shown the door. Starting with Ron Vara, err I mean Peter Navarro.

Markets:

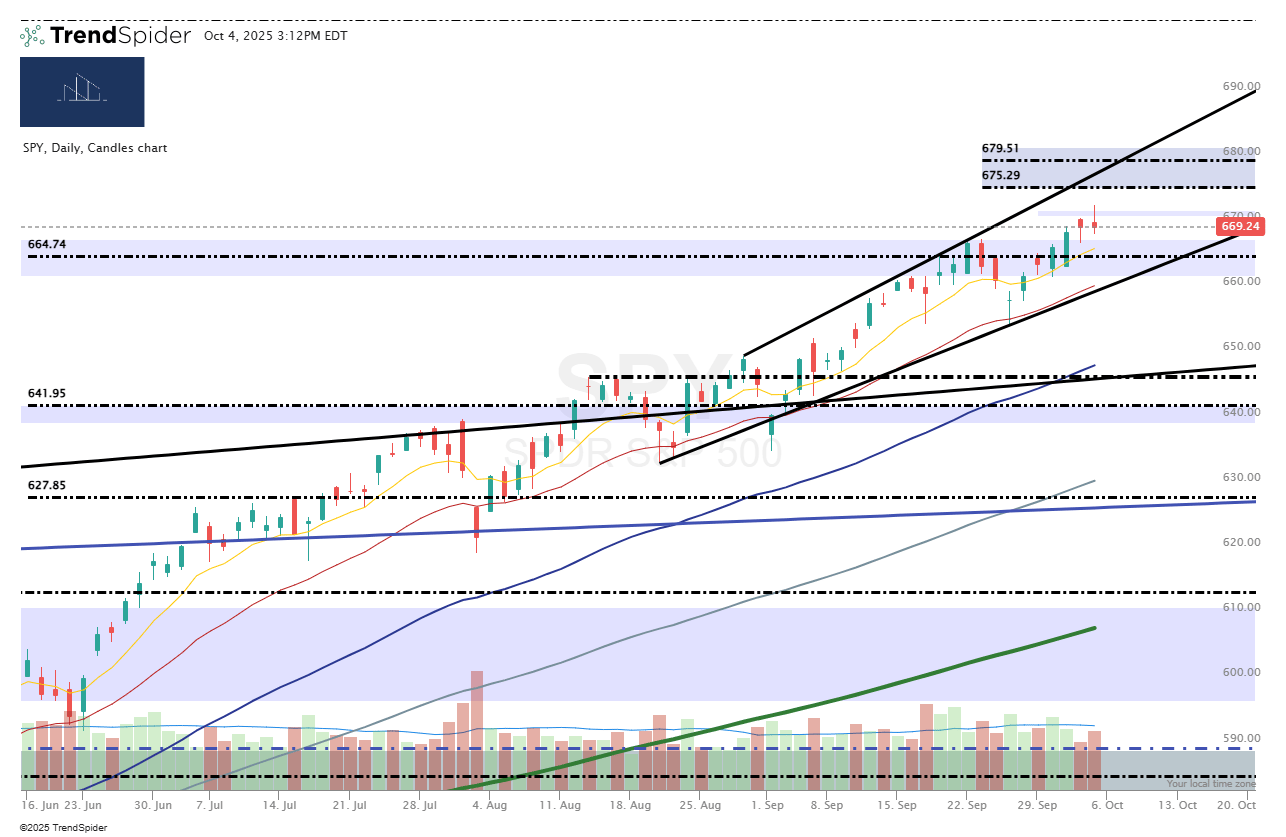

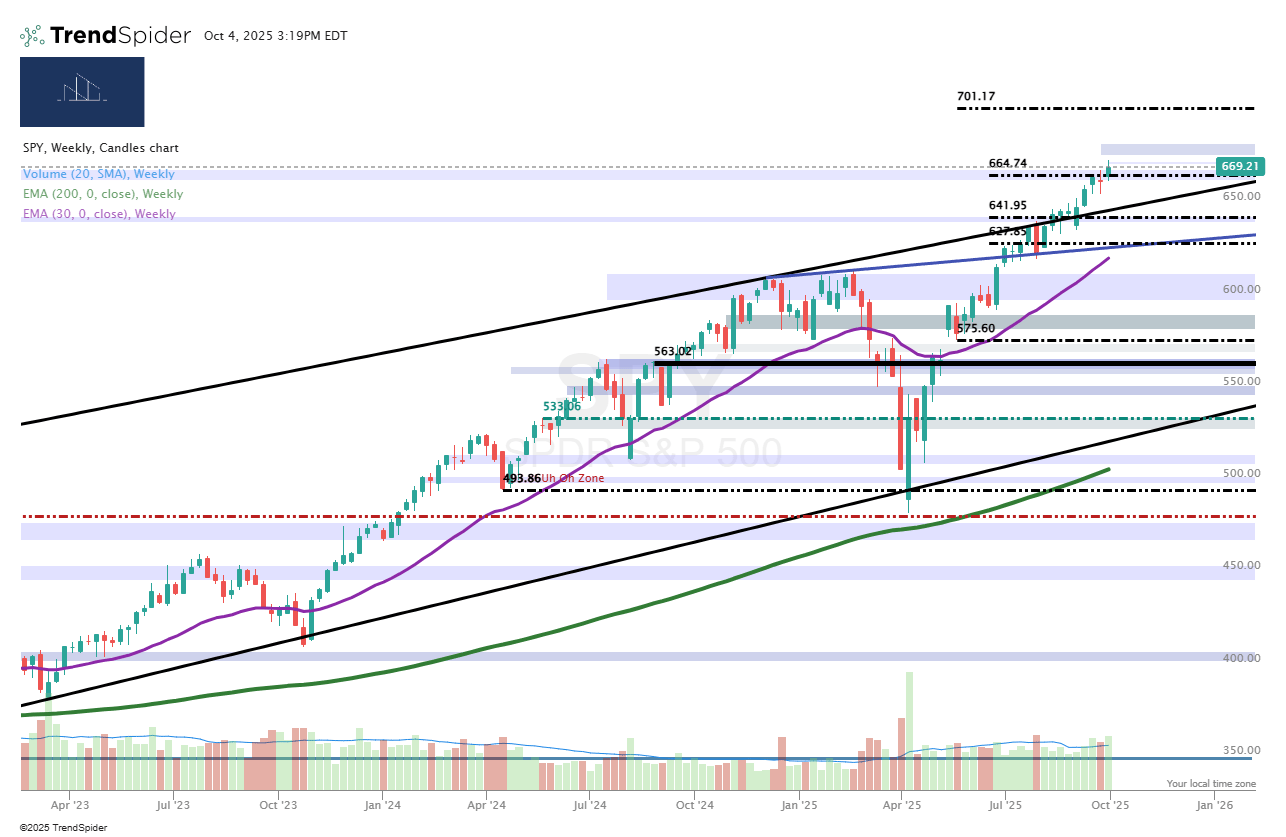

Markets continued to grind higher this past week after a brief pullback to the 21-day moving average the prior week. A healthy retracement that helped reset short-term momentum. We could see something similar again in the days ahead, as some short-term weakness crept in on Friday.

Heading into the week, my focus is on the $670.95–$671.71 zone on SPY.

Above that range: I expect the rally to resume toward $677ish, give or take a buck or two.

If we can’t reclaim the $670ish zone: I’ll look for a retracement to around $664, which would still be a healthy and constructive move.

As long as SPY continues to find support near its 21-day moving average, the trend remains intact. But if that level fails to hold, the next areas I’m watching for support are around $645, and then $630 if $645 gives way.

None of these scenarios are far-fetched. Markets remain impressively strong, and many stocks have logged massive short-term gains. Still, it’s worth remembering that October is historically the most volatile month of the year, so a sharper swing in either direction would not be unusual.

If we do see a 5% retracement, I’d treat it as another buying opportunity for what could be a strong year-end push. I continue to lean toward the more bullish outlook shared by other bullish analysts who expect SPY to reach around $700 by year’s end.

The “What If” Scenario

Now, if a more disruptive issue were to arise; say, the government shutdown drags on for weeks and starts to restrict liquidity, we could see a faster and deeper correction, something in the 15–20% range down to $575–$565.

That’s not my base case right now, but it’s a scenario worth keeping on your radar. If it does happen, I’d view it as a gift. A major opportunity to position for the next powerful rally into year-end.

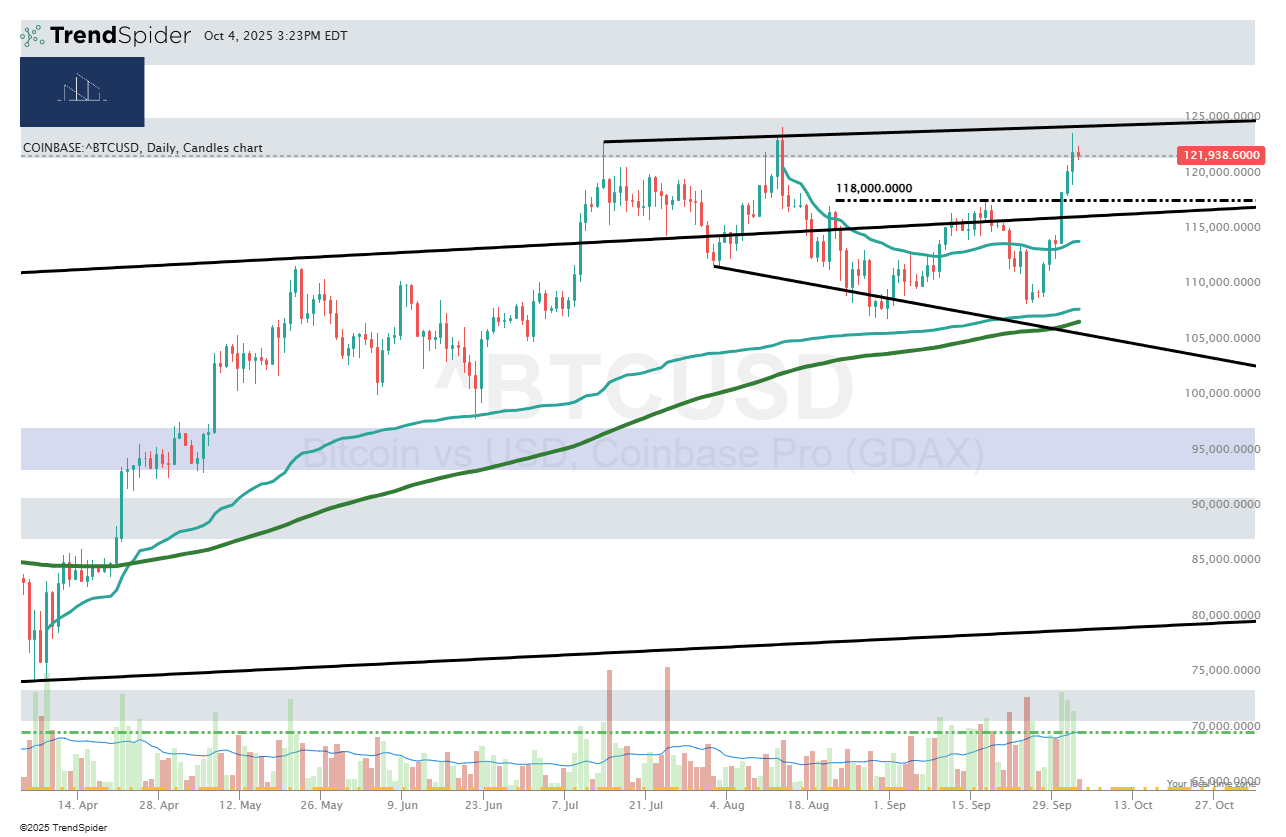

Using Bitcoin as an Indicator

One additional tell I’m watching closely is Bitcoin $BTC.X ( ▲ 1.05% ) . Last week it finally reclaimed the $118K level. If that level holds, it supports the bullish risk-on backdrop. But if Bitcoin breaks back below $118K, it could be the early signal that markets are gearing up for that deeper ~15% pullback.

Bitcoin - Daily Chart

Ultimately though, it’s hard to argue with this sort of strength in the markets.

$SPY ( ▼ 0.26% ) S&P 500:

SPY Weekly

$DIA ( ▼ 0.53% ) Dow Jones Industrial Average:

DIA Daily

$QQQ ( ▼ 0.38% ) Nasdaq:

QQQ Daily

$IWM ( ▲ 0.23% ) Russell 2000 (Small Caps):

IWM Daily

Melt-ups are a time to be bullish in stock markets and have a more speculative frame of mind.

But continue to keep your head on a swivel as the Healthcare sector $XLV ( ▼ 0.26% ) woke up with a vengeance this week. That is something you absolutely want to be aware of as healthcare stocks are typically strong and show relative strength in the run up to recessions.

There are always signs…

Significant Economic Data from the previous week:

Actual | Expected | Previous | |

|---|---|---|---|

JOLTS (Jobs Openings) (Aug) | 7.227M | 7.15M | 7.208M (Revised up from 7.181M) |

ADP Nonfarm Employment (Sept) | -32K | 53K | -3K (Revised down from 54K) |

Challenger Job Cuts (Sept) | -25.8% 54.064K | N/A | 13.3% 85.979K |

Avg Hourly Earnings (Sept) | Report delayed due to government shutdown. | 0.3 (MoM) N/A | 0.3 (MoM) 3.7% (YoY) |

Unemployment Rate (Sept) | Report delayed due to government shutdown. | 4.3% | 4.3% |

Nonfarm Payrolls (Sept) | Report delayed due to government shutdown. | 51K | 22K |

Economic Data to watch this week:

Date and Time | Expected | Previous | |

|---|---|---|---|

Avg Hourly Earnings (Sept) | Fri, Oct 10th @ 8:30a EST | 0.3 (MoM) N/A | 0.3 (MoM) 3.7% (YoY) |

Unemployment Rate (Sept) | Fri, Oct 10th @ 8:30a EST | 4.3% | 4.3% |

Nonfarm Payrolls (Sept) | Fri, Oct 10th @ 8:30a EST | 51K | 22K |

Quote of the Week:

“All past declines look like an opportunity, all future declines look like risk.”

Click the Leave a comment button if you have any questions or comments, or need something clarified. Don’t be shy. The main point here is to improve constantly. Questions and comments help us both and tells me what you are interested in learning/hearing more about.

If you enjoyed this post or found it useful, do me a favor and hit the like (heart button all the way back to the top of the post and to the left) and share it with others.

Reply