- The Economy Tracker

- Posts

- Here's the Deal

Here's the Deal

November 24, 2025

Jobs Market Continues to Show Early Signs of Deterioration

The government shutdown has created some inconvenient gaps in our economic visibility. It was confirmed this past week that we won't get October's inflation or employment figures. Particularly notable timing given that inflation has been trending higher and the job market continues to show early signs of deterioration.

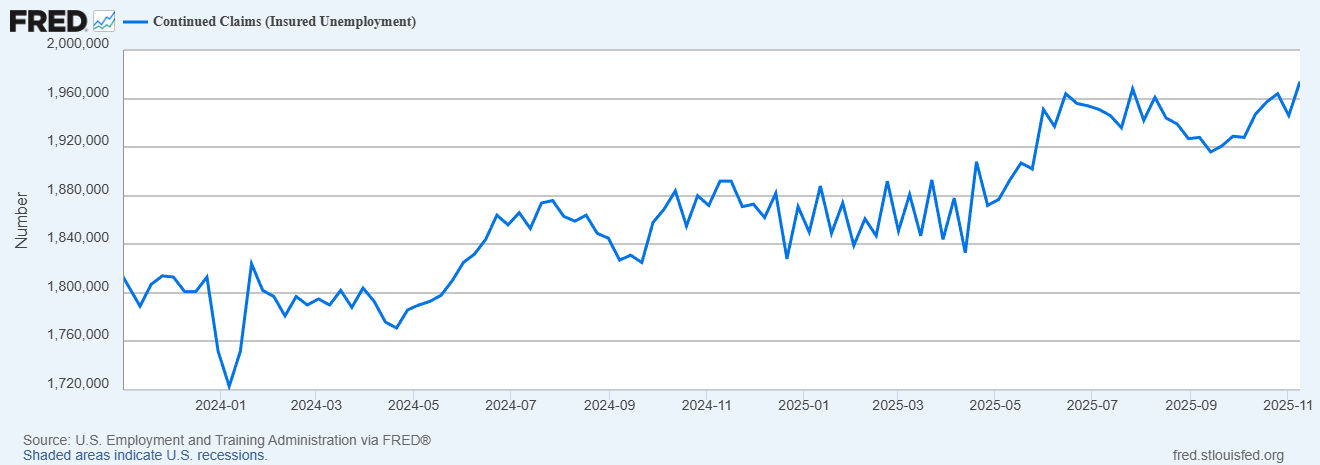

However, we did get September’s insights into the job market as those numbers were released last week. Here's what we are seeing: Continued Unemployment Claims keep climbing.

Unemployment - Continued Claims

This is one of the canaries in the coal mine. When people stay unemployed longer, it's typically the first domino to fall before initial claims start rising and unemployment surges at the beginning of recessions.

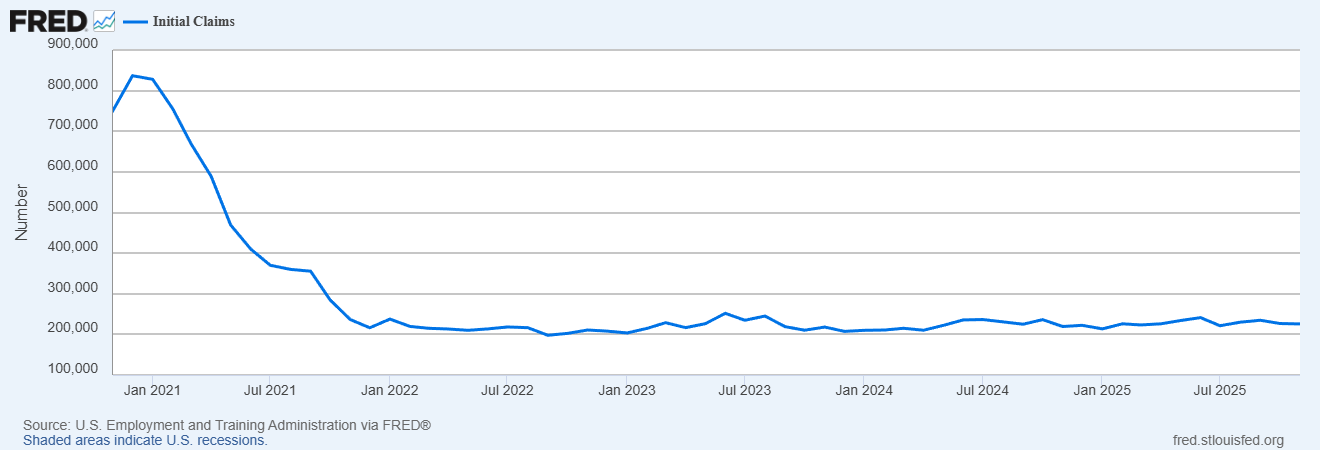

While Initial Claims has yet to begin following Continued Claims higher,

Unemployment - Initial (New) Claims

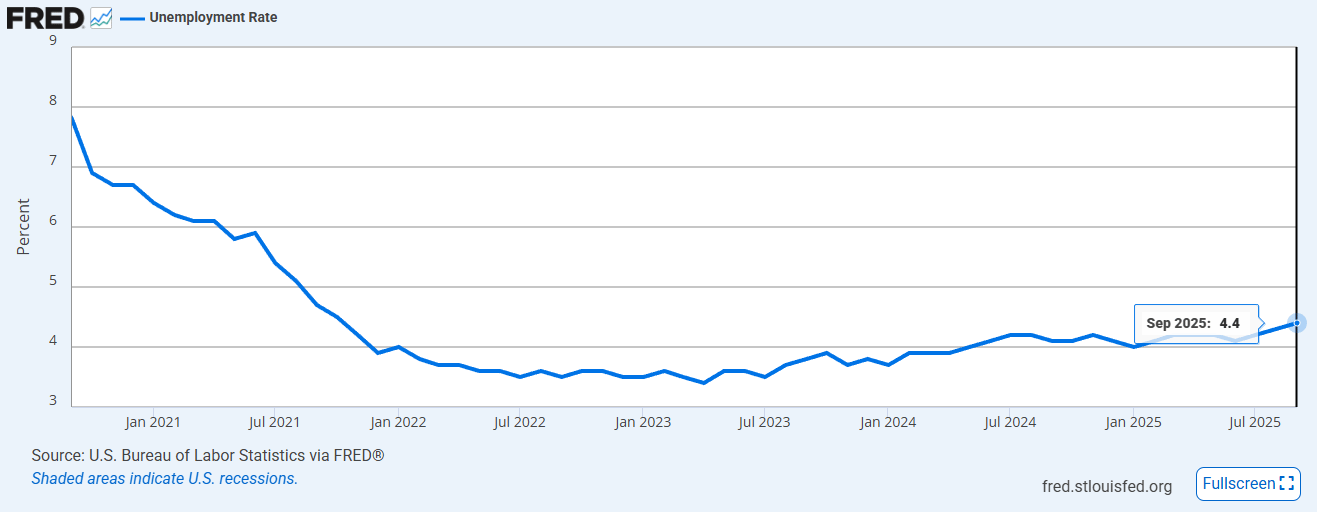

The September unemployment rate ticked up to 4.4%, confirming this pattern is already in motion.

Unemployment Rate

This weakening employment picture puts the Fed in a difficult position. They’re now forced to navigate rising inflation pressures at the same time job data is softening. The new tariffs are pushing inflation higher again, stacking on top of the already historically elevated levels we saw a few years ago. Those earlier spikes were driven by strained supply chains during the pandemic and an extraordinary surge in government spending and stimulus under both the Trump and Biden administrations.

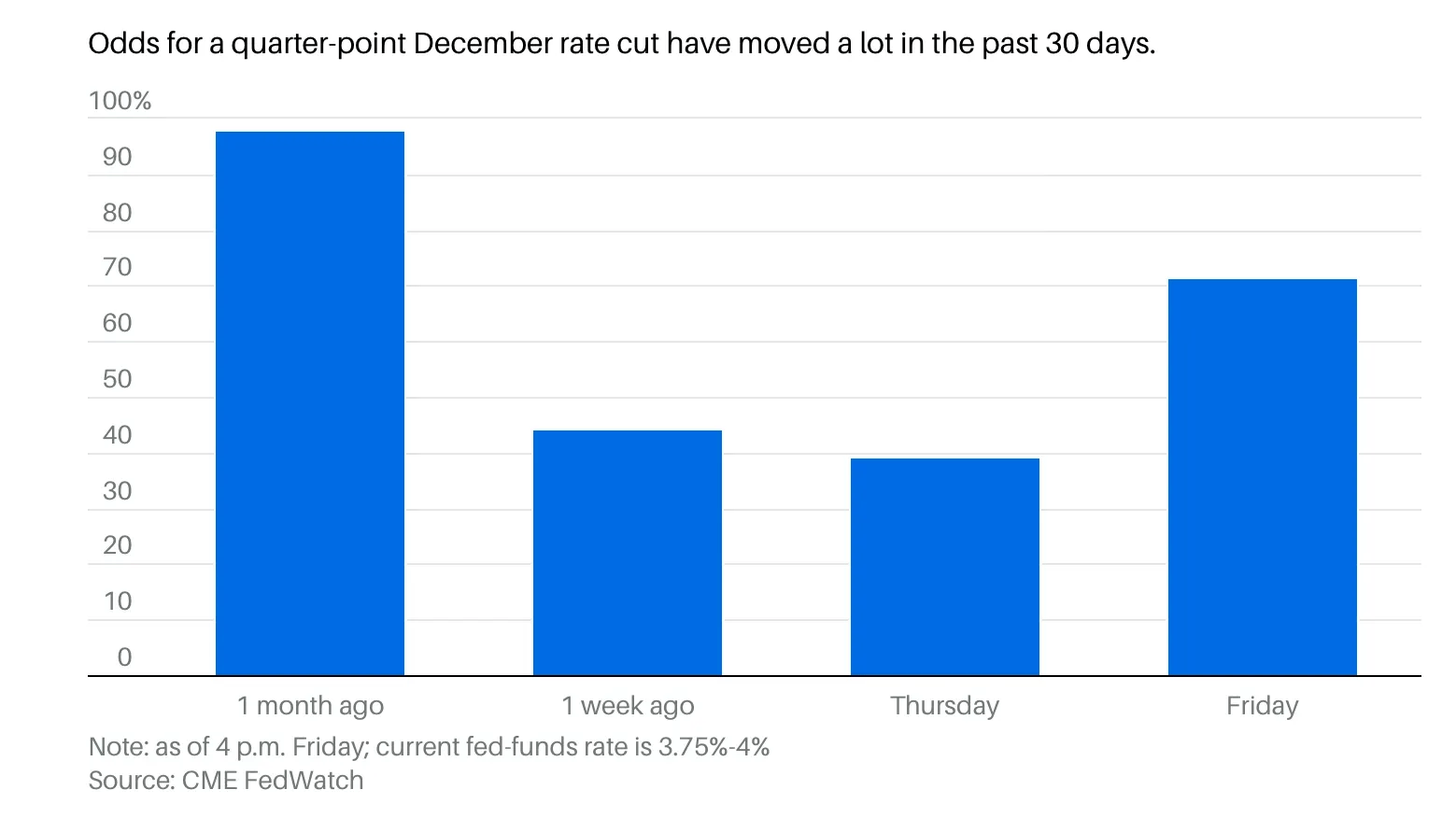

As a result, the odds of a December rate cut have been swinging wildly over the past few weeks.

We're now in a classic good news/bad news scenario: bad economic news increases the likelihood of rate cuts. This dance, where weakening fundamentals drive policy support, is a textbook sign of a credit cycle nearing its end.

Google Changes the AI Landscape

Google just made a major strategic shift with Gemini 3. For the first time, they've trained and deployed a frontier-scale model entirely on their own TPUs (Tensor Processing Units) rather than Nvidia GPUs. Earlier Gemini generations mixed TPUs and GPUs; Gemini 3 proves TPUs alone can handle state-of-the-art training and serving at scale.

Why does this matter? Google is breaking free from the "Nvidia tax." By using their own silicon end-to-end, they gain:

Supply independence from GPU scarcity and Nvidia's pricing power

Better economics through vertical integration of silicon, networking, and software

A competitive cloud offering where they can offer customers both leading AI models and access to the same TPU infrastructure

Gemini 3 is as much an infrastructure story as a model upgrade. They're establishing an alternative compute stack that could reshape competitive dynamics in cloud AI infrastructure.

Earnings Season Comes to an End

Q3 earnings just wrapped up, and the results couldn't be clearer: we're living in a sharply divided, "K-shaped" economy. Companies tied to AI are crushing it. Most everyone else? Not so much.

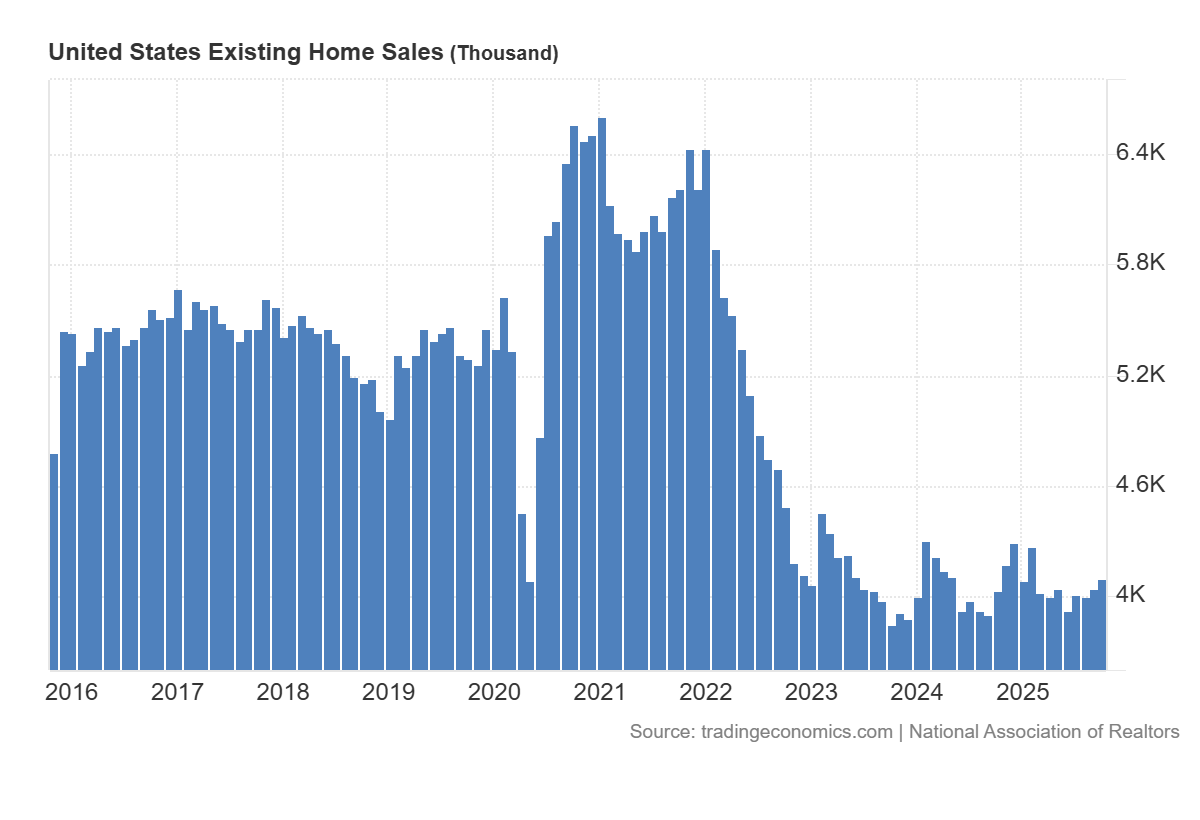

Home Depot $HD ( ▲ 0.13% ) : The Housing Slowdown Continues to act as a Brake on the Economy

Home Depot cut their 2025 earnings guidance from down 2% to down 5-6% year-over-year. Management didn't mince words, describing a "deep funk" in housing driven by low turnover, high mortgage rates, and consumer uncertainty.

Existing Home Sales - 10-Year Chart

The expected Q3 demand pickup never happened. Larger, financed renovation projects remain soft. People are still handling repairs and maintenance - replacing a water heater or fixing a leaky roof - but they're deferring the big, discretionary kitchen remodel or deck addition.

Walmart $WMT ( ▼ 1.73% ) : The Trade-Down Economy

Walmart posted strong numbers; revenue up 5.8%, U.S. comparable sales up 4.5%, and e-commerce surging 27%. They even raised full-year guidance.

But look closer at who is shopping there and what they're buying. The company is gaining market share as more wealthy and upper-middle-class consumers trade down, looking for savings as the economy weakens and inflation stays elevated. The mix has shifted heavily toward value, groceries, and essentials rather than discretionary purchases.

Lower-income customers remain under real pressure, but Walmart's ability to maintain stable margins while capturing this trade-down business shows aggregate consumer spending is holding, just barely, and with a very different composition than before.

The consumer isn't collapsing, but they're definitely strategizing. The K-shape economy is real: middle and high-income households are still spending but hunting for value, while lower-income households continue to be genuinely strained.

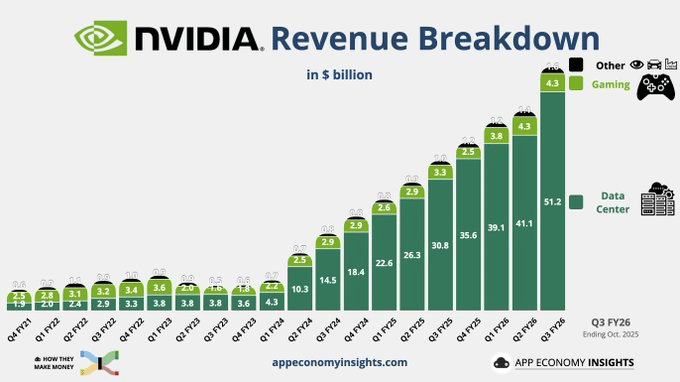

Nvidia $NVDA ( ▲ 1.63% ) : The AI Boom Roars On

Then there's the other side of the K. Nvidia reported another blowout quarter: $57 billion in revenue, up 62% year-over-year, with data center revenue hitting $51 billion. Management described demand for their Blackwell GPUs as "off the charts," with cloud GPUs essentially sold out.

But here's the interesting market reaction: despite the stellar numbers, the stock gave up its initial gains and then some by day's end. A common theme of this earning season. This pattern of stocks getting sold off on huge earnings beats is classic late-cycle behavior. It's what typically happens when markets start worrying about sustainability rather than celebrating current strength.

The Late-Cycle K

This earnings season solidified that we're in a late-cycle economy with a sharp divide:

At the top: AI investment is massive and real, driving extraordinary growth in tech infrastructure and related industries.

In the middle: Value-conscious consumers are shifting to essentials and trading down to cheaper options, keeping aggregate spending afloat but with weakening quality.

At the bottom: Housing-related demand is soft, lower-income households are under strain, and early recession warning signs are flashing in unemployment data.

With the credit cycle aging the question is: How long the AI boom can support the top half while the bottom continues to weaken and grow in numbers?

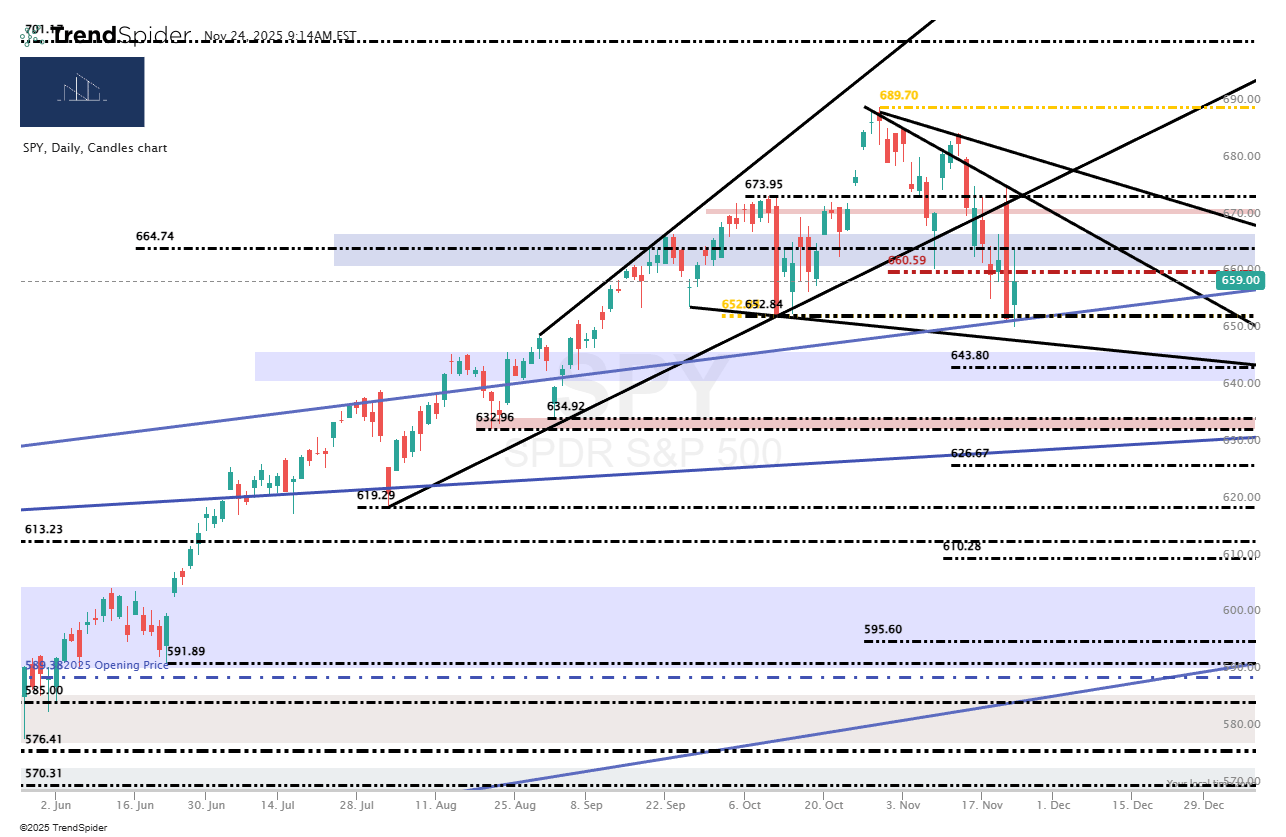

Markets:

Markets stumbled hard last week as NVDA gave back all of its post-earnings gains—despite another outstanding quarter. That reversal pressured the broader market, and SPY failed to reclaim the key 670 level before sliding sharply down to $651.

Heading into this shortened week, the roadmap hasn’t changed: it’s all about the 670–675 zone. If SPY can push back above that range and hold it on a retest, the path to new highs by year-end remains open. If it can’t, then the downtrend likely continues, with the next downside levels sitting around $644, then $635–630, and finally $610.

$SPY ( ▲ 0.5% ) S&P 500

SPY Daily

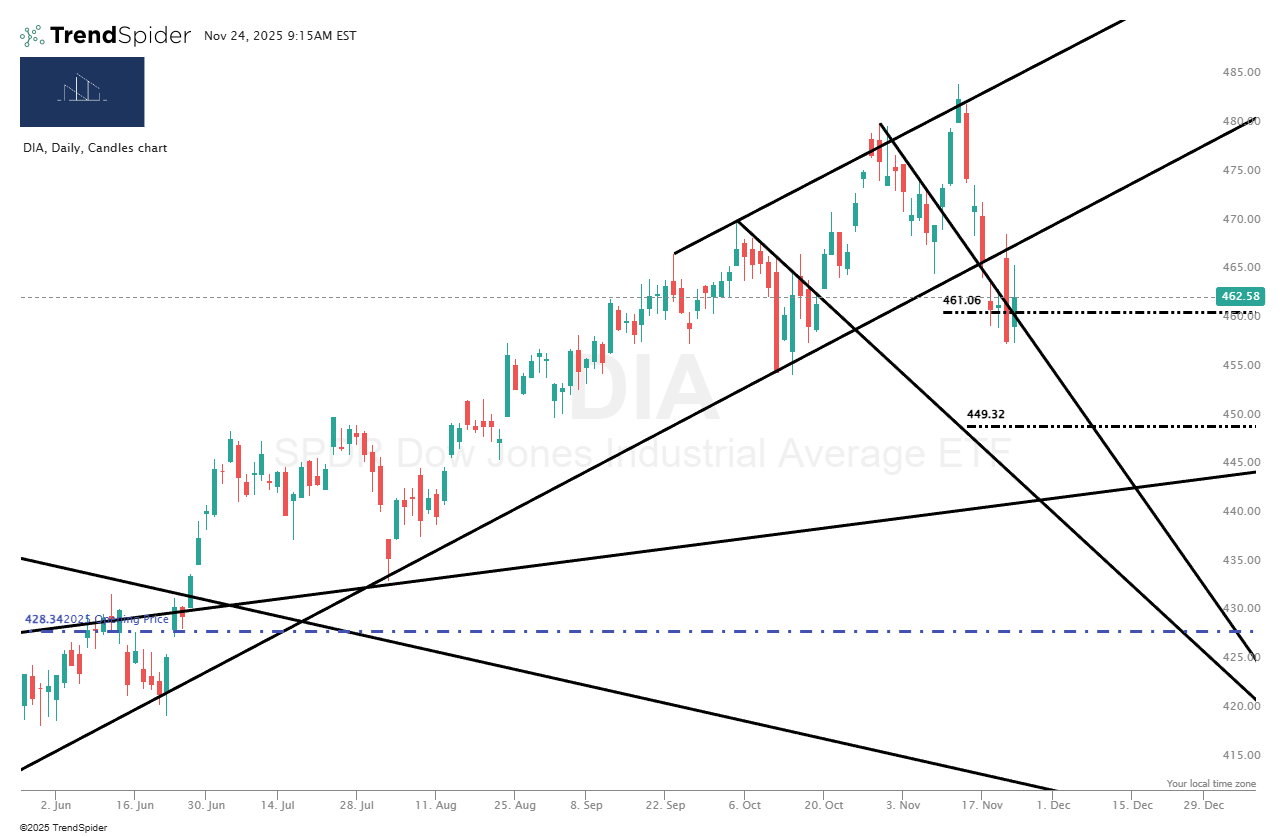

$DIA ( ▲ 0.23% ) Dow Jones Industrial Average:

DIA Daily

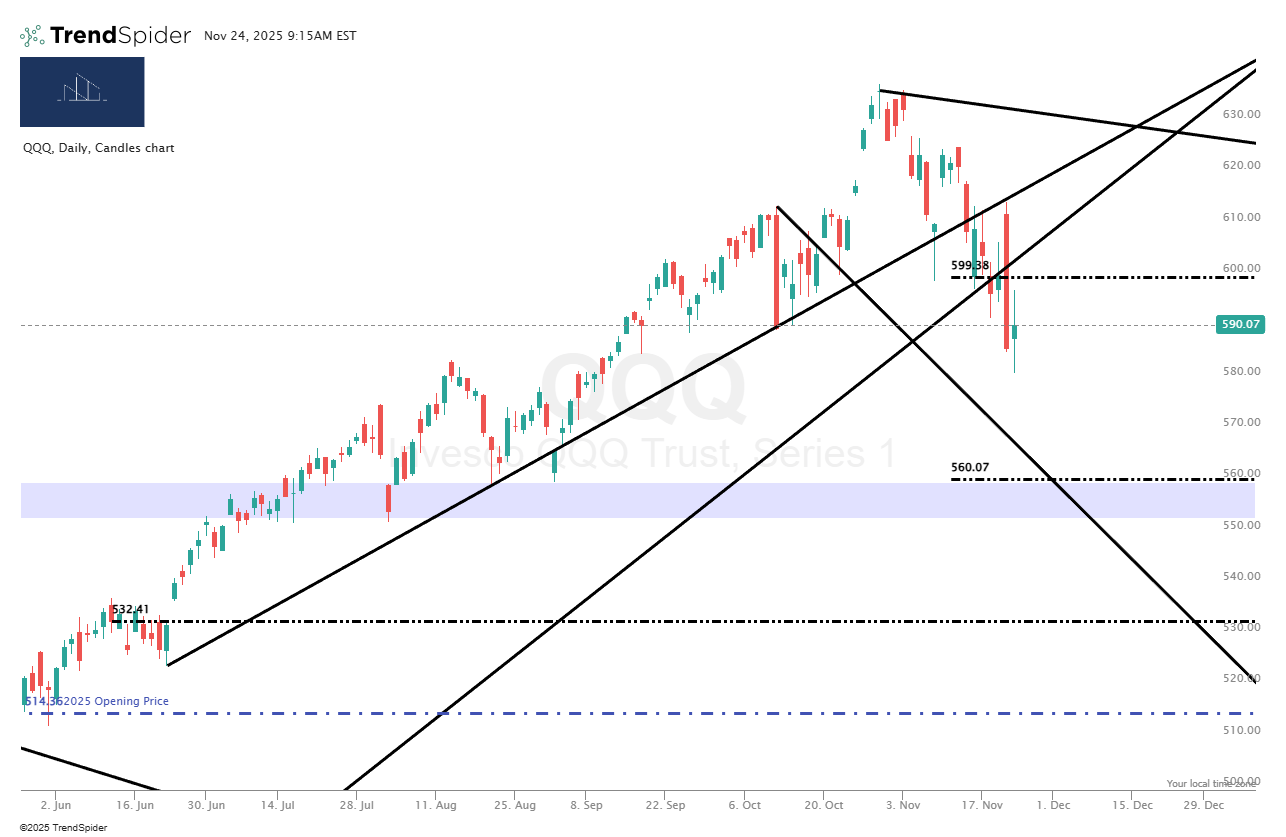

$QQQ ( ▲ 0.75% ) Nasdaq:

QQQ Daily

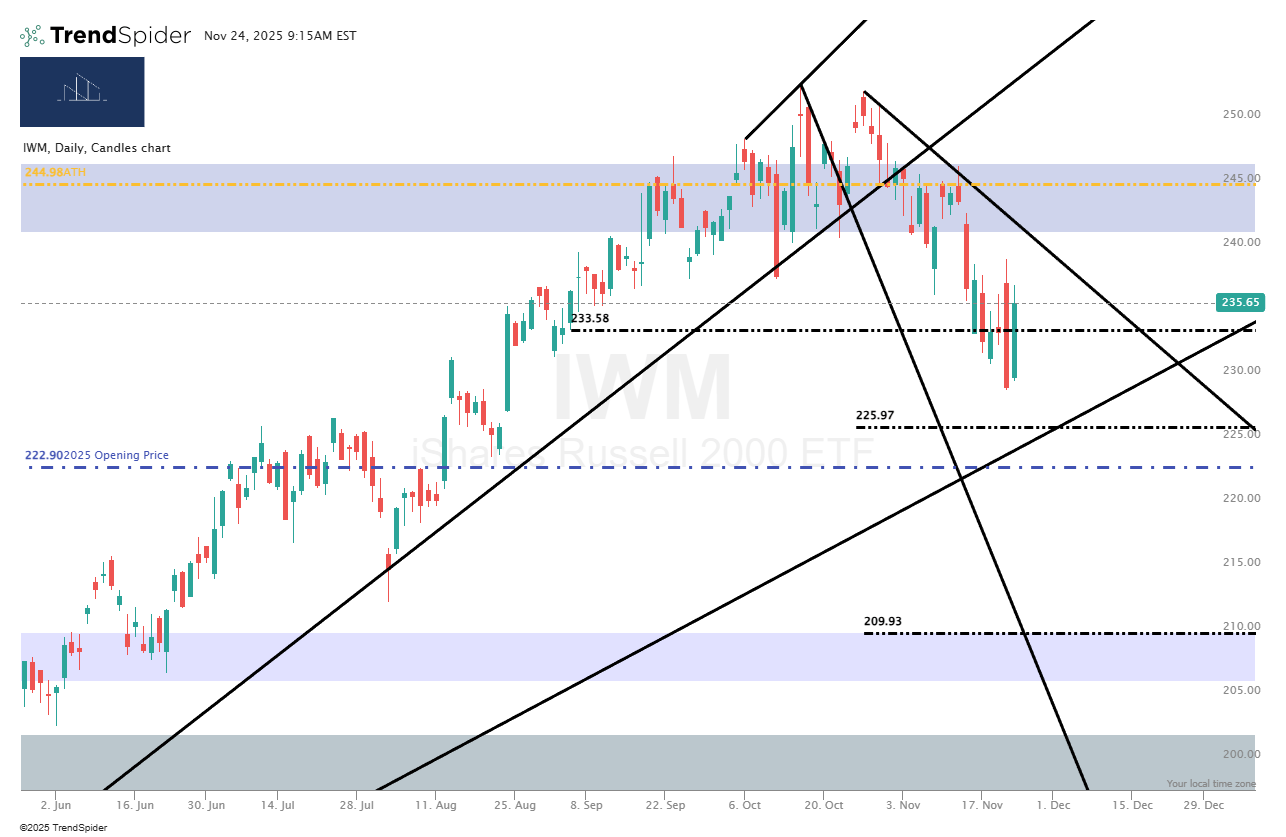

$IWM ( ▲ 0.36% ) Russell 2000 (Small Caps):

IWM Daily

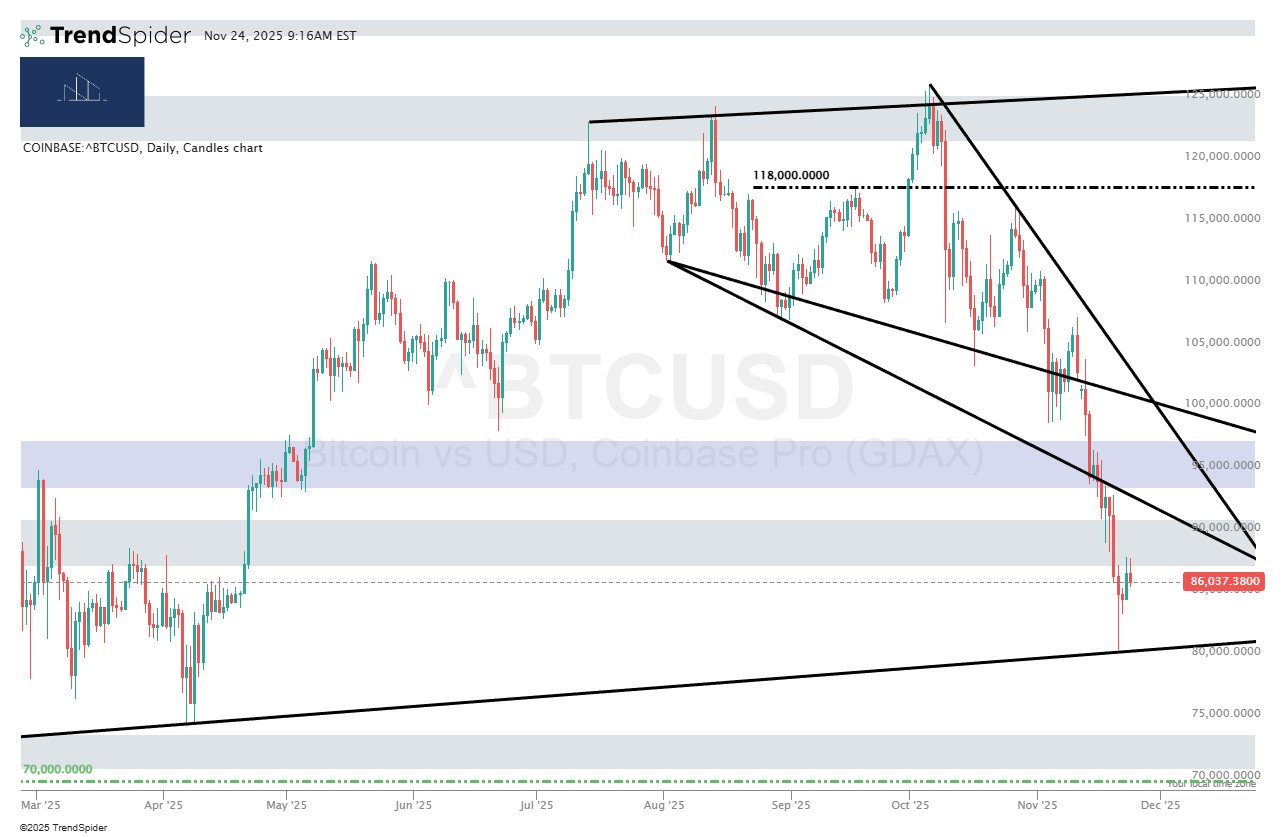

Bitcoin $BTC.X ( ▼ 1.51% ) continues to struggle, unable to hold any meaningful upward momentum. That’s not what you want to see if you’re rooting for higher stock prices, because weakening Bitcoin typically reflects a “risk-off” shift beneath the surface.

A massive change of character would be if equities suddenly found strength and pulled Bitcoin higher with them. If that happens in the coming days, I’d view it as an opportunity to trim long-term Bitcoin and other crypto positions. At this point, the writing might be on the wall: crypto could end up being a dead trade for the next 5–10 years, especially in a secular bear market where gold, silver, and platinum historically outperform and serve as the more reliable stores of value.

Bitcoin - Daily Chart

WTF of the Week:

Quote of the Week:

“You can get in way more trouble with a good idea than a bad idea because you forget that the good idea has limits.”

Click the Leave a comment button if you have any questions or comments, or need something clarified. Don’t be shy. The main point here is to improve constantly. Questions and comments help us both and tells me what you are interested in learning/hearing more about.

If you enjoyed this post or found it useful, do me a favor and hit the like (heart button all the way back to the top of the post and to the left) and share it with others.

Reply