- The Economy Tracker

- Posts

- Here's the Deal

Here's the Deal

November 10, 2025

There's a lot happening in the economy and markets. It all makes sense and aligns with what you'd expect at this point in the cycle, but much of it seems contradictory. That's why it feels messy. Our media ecosystem, built on engagement and views rather than education, doesn't help.

When economic and market cycles become less aligned (which happens in predictable patterns), the world becomes harder to read through the lens that works 80% of the time. Right now, we're in one of those periods. And when life gets unclear, humans tend to make terrible decisions, financial and otherwise.

That's why I'll be sending out more newsletters explaining some of these more important current issues in more depth. The intent of which is to lay a clear foundation of where we are in the economy and markets, to make it easier to follow along and benefit from the changes taking place. My hope is that this will help you spot and understand the longer-term opportunities which are becoming available.

Here's Where We Stand

The data, patterns of human behavior, and cycles all point to the same conclusions at the moment:

We're morphing out of a Secular Bull Market and into a Secular Bear Market

We're at the tail-end of the current credit cycle; somewhere between late Economic Slowdown and early Recession

Expect higher inflation rates than the decade before the Pandemic to continue

Expect higher interest rates (relative to the past 10-20 years) to continue as well

Stock markets and many individual stocks still have huge upside potential in the near-to-medium term (weeks and months, not years)

Multiple MASSIVE generational wealth-building opportunities, such as the one in Natural Gas highlighted in last week’s Here’s the Deal, will last 5-10 years and are just now beginning

There’s a lot of confusion regarding markets and the economy at the moment. That is precisely when the best long-term and eventually life-changing opportunities are most available.

For most, the economy right now is tough and it will get tougher before it gets better. But that doesn’t mean that there aren’t incredible opportunities available today.

Don’t allow your current political views to get in the way of your future prosperity.

The world is always great and gross at the same time. Whatever. Get over it. There’s nothing you can do about it unless you prosper first.

“Put your oxygen mask on first before helping others.” There’s a reason why this is one of the first rules.

A New Warning Sign

You may disagree with my assessment of the current economic cycle and point to last quarter’s GDP growth of 3.8% as proof I'm wrong. But consider this: data center construction made up 92% of total US growth in the first half of the year. That means without data center construction, the US only grew 0.1% in the first half of 2025. Let that sink in.

When one very small sector (in terms of people who benefit financially) accounts for that much of the nation's entire growth, the end of the current credit cycle is near. That sort of thing is neither good nor healthy.

October's Layoff Surge

Layoff announcements in October 2025 surged to 153,074, making it the worst October for job cuts since 2003.

What's driving it? Companies are citing cost-cutting measures and rapid adoption of artificial intelligence, along with a general cooling in consumer and corporate spending. These are exactly the patterns you see at the tail-end of a credit cycle.

Republicans Get Trounced in Elections

This past week's elections told a clear story: voters are deeply concerned about the economy, and they're voting accordingly.

Economic worries such as inflation, high costs of living, and affordability dominated the public mood and drove results that favored Democratic candidates across key races in Virginia, New Jersey, California, and New York City. Exit polls and surveys showed most voters rated current economic conditions as poor or only fair, with dissatisfaction markedly higher than last year. In the regions polled, President Trump's economic management was viewed negatively.

This week's results underscored that economic anxiety, not culture-war issues, is currently driving voter behavior. Something to keep in mind as mid-term elections are only a year away.

Supreme Court Challenges Trump’s Tariff Authority

This past week, the Supreme Court signaled strong skepticism toward President Trump’s use of emergency powers to impose broad tariffs on foreign imports. During oral arguments, justices questioned whether the president has the legal authority to use the International Emergency Economic Powers Act (IEEPA) to levy near-universal tariffs without congressional approval.

While some justices noted that emergencies might justify temporary flexibility, the majority tone leaned toward restraining executive overreach.

Markets Responded Positively

Interestingly, as news broke that the Court sounded skeptical of the Constitutionality of the new tariffs, markets breathed a sigh of relief. Stabilizing and then moved higher intraday.

That tells us that markets don’t see the end of Trump’s tariff policy as a risk, but rather as a relief.

The reason is that tariffs are taxes. And broad tariffs, like those proposed, work just like a backdoor tax increase on American consumers and businesses.

The result of which has President Trump working overtime to try and save the policy.

Trump is either becoming out of touch on the economy and experiences of most Americans to an extreme at the absolute worst possible time, or this is simply a last ditch effort to save the policy.

Either way, here’s the economic reality of Trump’s proposal:

If the government sends every household $2,000 while raising tariffs on imports, companies simply pass more of those higher costs from tariffs along to consumers.

With more money in their pockets and higher costs at the same time, demand rises while supply becomes more expensive. This fuels more inflation.

We just lived through this dynamic during the pandemic: stimulus checks + supply constraints + increased government spending + QE = inflation spike.

So when Trump argues that removing tariffs would “hurt the economy,” markets, and basic Economics 101 disagree.

The Political Question for Republicans

This leaves Republicans with a defining choice:

Follow a short-term populist promise of a tariff-funded “free ice cream” bribe to voters, or

Stick to long-standing conservative principles: smaller government, lower taxes, and free-market trade.

Whatever happened to working to cut taxes, stop increasing spending, and avoid increasing the burden on the majority of Americans in the first place?

What Happens if the Court Strikes Down Tariffs?

I’ve been asked this a lot. Here’s the answer:

No market crash. Likely the opposite. This past weeks action suggests either a rally or a set up into a “buy the rumor, sell the news” reaction if it becomes more apparent that tariffs will get struck down.

Expect inflation pressures to ease: possibly re-aligning with the Fed’s 2% target or a bit below for a short period of time.

In short: nothing bad.

The way for Trump to get out of this is to admit he was led astray on financial policy as so many Americans are, fire his entire economic team with the exception of Scott Bessent, and start fresh ASAP.

“It’s the economy, stupid.” remains as relevant today as it was 35 years ago.

If a change isn’t made soon, the blue wave in next year’s midterms will be massive and more than likely more Socialists will take office.

Adding cost burdens on the American people while increasing government spending, and then offering to send some crumbs back as a bribe? What kind of proposal is that? Who benefits the most in that situation? Because it sure isn’t the vast majority of US citizens.

Earnings Season: Week 5 of 6

This past week's earnings continue to paint a picture of an extreme K-shaped economy. Technology, AI infrastructure, and upper-income consumer spending remain remarkably strong. Meanwhile, rate-sensitive industries and capital-intensive businesses are showing clear signs of strain, as are lower and now middle-income consumers .

S&P 500 earnings are expected to grow about 8% for Q3 overall. Solid, but with increasingly divergent stories underneath that headline number. Again, another sign of a credit cycle coming to an end.

Technology & AI: The Clear Winners

The standout theme continues to be AI and cloud infrastructure. AMD, Palantir, and Arista Networks all reported accelerating demand, with enterprise clients, hyperscalers, and even government agencies ramping up investments heading into 2026. Alphabet and NVIDIA (reporting late October but driving sentiment this week) reinforced that corporate spending on digital infrastructure isn't slowing down, but rather accelerating.

The message is clear: companies are continuing to bet big on AI, and that investment cycle is still very early.

The Consumer Story: A Tale of Two Households

McDonald's Q3 results perfectly capture the divided consumer landscape. Same-store sales grew 2.4% in the U.S. While it’s a win on paper, digging deeper reveals that growth came almost entirely from higher-income customers, not from increased traffic from value-conscious diners.

CEO Chris Kempczinski was direct: lower-income households are still feeling the squeeze from high rents, food prices, and living costs. He expects this pattern to continue into 2026. McDonald's is managing through promotions and menu innovation, but the underlying weakness in their core customer base is real.

On the flip side, Uber and Airbnb showed that discretionary travel spending remains surprisingly robust. Post-pandemic behavioral changes, flexible payment options, and product innovation are keeping people moving, even as some segments become more price-sensitive.

Robinhood added another data point: retail trading activity surged in Q3, confirming that there was still an appetite for risk.

While tech, travel, and operationally efficient leaders continue beating expectations, management teams across rate-sensitive and capital-intensive sectors are warning about soft Q4 demand. The labor market shows early signs of cooling, yet companies still face persistent wage and cost pressures.

The consensus outlook for corporations: moderating, not collapsing. Growth is slowing selectively, but the economy wasn't breaking yet last quarter.

With over 90% of S&P 500 companies already reported, this final week focuses on sector nuances and bellwether guidance. Here's what to watch:

Entertainment & Consumer Discretionary

Walt Disney: Will reveal how consumers are spending on streaming, theme parks, and experiences.

Energy

Occidental Petroleum: Will shed more light on U.S. commodity production strategy and how producers are managing oil and gas price volatility.

Innovation & Growth

CoreWeave, Rocket Lab, Plug Power: Early indicators of momentum in cloud infrastructure, space ventures, and next-gen energy.

International & Food

Sony, Tencent Music, JD.com: Global consumer trends, tech spending, and entertainment sector health outside the U.S.

Tyson Foods: Input costs, protein demand, and food spending patterns among price-conscious consumers.

We're seeing a selective economy: AI and tech infrastructure are booming, high-income consumers and travelers are spending freely, but lower-income households and cyclical industries face genuine headwinds. This week's final earnings reports will help clarify whether strong segments can carry the economy forward, or whether growing cracks will start to weigh on overall momentum as we close out 2025.

Markets:

The Hindenburg Omen, a technical market indicator meant to signal an increased probability of a stock market crash or sharp correction, triggered this week. It’s triggered when the following are observed:

both a large number of NYSE stocks hit new 52-week highs and lows on the same day (usually at least 2.2%–2.8% of listings)

the market is in an uptrend

a market breadth indicator like the McClellan Oscillator turns negative.

Now, to be clear, the Hindenburg Omen doesn’t guarantee a crash and it’s infamous for false alarms.

The trick is to learn to recognize when it’s a warning that matters versus when it’s just noise.

This is one of those times it’s worth paying attention. As it is also confirming the market breadth issue pointed out last week.

While it doesn’t necessarily mean that a crash is imminent, ultimately money now appears to be rotating out of tech, discretionary, and other expansionary sectors and into energy and healthcare.

This is also the exact thing you see at the tail-end of a credit cycle.

Unfortunately, that also suggests energy prices are likely to rise in the coming months.

That’s why I highlighted $CRK ( ▼ 2.47% ) (Comstock Resources) last week and $TALO ( ▼ 3.74% ) (Talos Energy) below. As one way to offset the pain of higher prices is to own the beneficiaries of the next secular energy cycle.

$SPY ( ▲ 0.16% ) S&P 500

We got the early week weakness out of SPY in which it dropped to ~$675. Which is where I thought it would find some softer support. It did on news out of the Supreme Court questioning the constitutionality of Trump’s tariffs.

However, it did not hold there the following day and got down close to about $660ish before catching a bid on Friday morning, ending the week strong.

SPY Daily

Should $660ish continue to hold, then back to new highs and $700+ we go.

However, I could also see a low of $650ish this week on a nutty headline or post from the President which markets flush on and then quickly get bought back up.

While the economy is shaky, markets continue to be in a “risk-on” environment. Just make sure you aren’t looking to the same names to lead the charge as rotation is clearly playing out.

$DIA ( ▲ 0.12% ) Dow Jones Industrial Average:

DIA Daily

$QQQ ( ▼ 0.1% ) Nasdaq:

QQQ Daily

$IWM ( ▲ 0.03% ) Russell 2000 (Small Caps):

IWM Daily

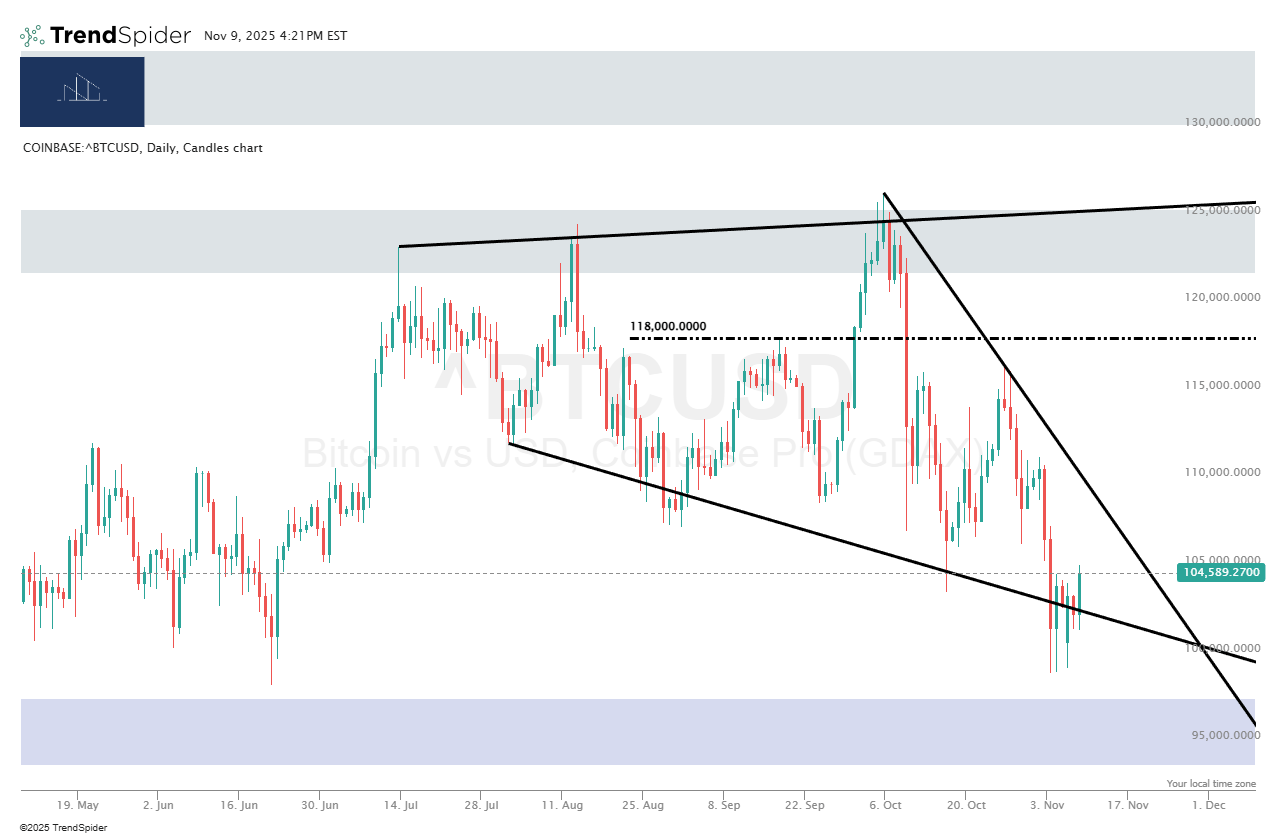

Bitcoin $BTC.X ( ▼ 2.04% ) is still struggling to gain real traction, but it’s quietly showing signs of stabilization. The longer it holds current levels, the more likely it is to set up for a push higher.

Bitcoin - Daily Chart

Keep in mind that historically, November is one of the strongest months for markets, and seasonal tailwinds are still at our backs.

Energy and Commodity Trends:

Two weeks ago, we discussed how oil and gasoline prices were beginning to show early signs of bottoming. And how that pattern was continuing to develop and is worth keeping on your radar and setting up some clear opportunities in Natural Gas. Which again, makes sense when you consider the bigger picture: AI usage is rapidly increasing power demand, and natural gas is one of the few energy sources that can scale quickly to meet that demand until nuclear capacity is rebuilt, which will likely take about a decade.

Comstock $CRK ( ▼ 2.47% ) is up over 30% since last Friday, and another natural gas name now looks to be sitting on the launch pad.

Natural Gas Play: $TALO ( ▼ 3.74% ) Talos Energy, Inc.

TALO - Weekly Chart

WTF of the Week:

Quote of the Week:

"Thus a wise prince will think of ways to keep his citizens of every sort and under every circumstance dependent on the state and on him; and then they will always be trustworthy."

Click the Leave a comment button if you have any questions or comments, or need something clarified. Don’t be shy. The main point here is to improve constantly. Questions and comments help us both and tells me what you are interested in learning/hearing more about.

If you enjoyed this post or found it useful, do me a favor and hit the like (heart button all the way back to the top of the post and to the left) and share it with others.

Reply