- The Economy Tracker

- Posts

- Here's the Deal - June 16, 2025

Here's the Deal - June 16, 2025

Weekly Economic and Market Report

Economy: In early Recessionary Phase (Not necessarily a recession, yet.)

Market Cycle: Bull Market

Week 24 of 52 for 2025: 46.15% of the way through 2025

Weekly Note:

It’s now been two years since the OceanGate submersible, Titan, tragically imploded next to the wreckage of the Titanic. For those familiar with the company or with any real-world experience in engineering, carbon fiber, or R&D, the failure was sadly predictable.

What has been surprising as new documentaries have recently come out, is the level of hubris and willful blindness shown by the company’s founder, Stockton Rush. Without spoiling the entire story for those who wish to watch, it’s important to understand that there was ample data long before the final dive indicating serious structural issues with the sub as multiple warning signs emerged and progressed during earlier missions. Data which OceanGate themselves used to monitor the soundness of the sub had made it clear that the vessel was facing serious risks. Yet, rather than addressing them, Rush chose to push forward.

His refusal to acknowledge the data which showed serious design flaws led directly to the unnecessary deaths of five people. Admitting to the flaws would have meant acknowledging that his entire design and business concept were fundamentally flawed from the start, a bitter pill for anyone to swallow. And in this case, that refusal carried lethal consequences for both himself and others who trusted him.

Unfortunately, we’re watching a similar kind of denial play out right now with the U.S. economy under the Trump Administration.

Like Titan, warning signs are building in the data around a set of risky economic policies built on faulty assumptions. And just as Rush ignored data that didn’t fit his vision, the administration, and those who blindly support them, are choosing to look past economic realities to defend a provably false narrative.

The data is there, and it’s becoming increasingly difficult to miss.

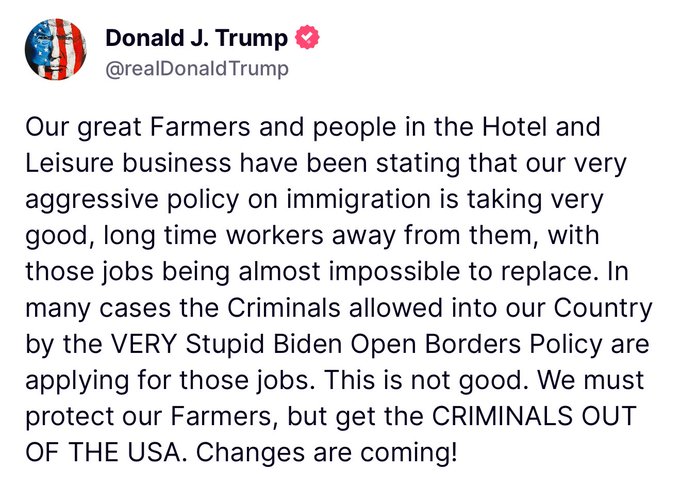

But maybe there is some hope after all with this past week’s major pivot by Trump on the necessity of immigrant labor:

Trump’s pivot on immigration.

Credit where credit is due on this one as Trump’s reversal on immigration is a huge plus for the economy as it will help keep the price of food from going MUCH higher by addressing the labor needs of farmers. And I’m sure the fact that the President himself owns a number of resorts, hotels, and golf courses around the country had absolutely no bearing on including the Hotel and Leisure industries in this policy change what so ever. Lol.

This, of course, triggered outrage from large swaths of his base, who continue to cling to the illusion that restricting immigration somehow strengthens the economy for the majority of citizens. They ignore the simple math: if domestic workers were to replace immigrant labor in many of these roles, wages would need to rise so sharply that food prices could easily triple.

Inflation: Lower than expected, but still high and curling back up.

This week’s inflation readings came in slightly below estimates, and right on cue, many rushed to declare victory. But this is exactly how economic headlines often obscure the full picture.

Yes, both CPI and PPI were modestly below expectations. But both were still higher than last month’s readings. That matters. At a minimum, this tells us that tariffs and the mess surrounding their rollout have already begun to halt the previous downward trend in inflation. And we’re still in the very early stages of these effects showing up in the data.

If anything, commodity prices appear to be just starting another leg higher. That brings more inflation, not less. This can temporarily push stock markets up and create the illusion that policies are working for those who don’t understand how the system works or flows. But like every illusion, this one only lasts until the bill comes due. When it does, many will once again be caught off guard, not because the signs weren’t there, but because they simply never bothered to study how markets and economies function in the real world.

It requires a fair amount of willful ignorance to look at the data and claim that inflation has been conquered for this cycle.

Take tariffs, for example. The price hikes they trigger may be technically “one-time events” as the tariffs roll through the system over several months. But once those higher prices are embedded, they become the new baseline, just as we saw with prices over the past few years. Inflation readings may moderate on a month-to-month or year-over-year basis later, but the elevated price levels remain.

However, should the tariffs work in bringing back large swaths of manufacturing to the US, the result would be an even more prolonged time (years) of consistently higher inflation in those industries and sectors being re-shored due to higher wages in the US.

Ironically, many of the same voices now downplaying the effects of any higher prices from tariffs were the loudest critics when inflation was surging a couple years ago. Their arguments shift depending on which political narrative they’re defending, often without any awareness of how contradictory those positions truly are. It’s a perfect case study in how political dogma blinds people to basic economic reality.

Couple that with the current and coming surge in power prices, and higher rates of inflation can get a whole lot more sticky in the coming months.

While the situation isn’t dire, we are clearly not out of the woods yet on the inflation front.

Breaking Down the New US-China Trade Deal

This week, the U.S. and China announced a new trade deal following negotiations in London.

Here’s what’s in the deal:

New U.S. Tariffs on Chinese Imports

The U.S. will now impose a combined 55% tariff on imports from China. While that’s lower than the 145%+ peak levels reached earlier this year, it remains extremely elevated compared to pre-trade war norms and consumers will be footing the majority of the bill. The 55% total is made up of multiple layers:

10% baseline tariff: applied broadly to nearly all imports from China.

25% Section 301 tariff: originally imposed during Trump’s first term, covering most Chinese goods as part of the intellectual property and trade practices dispute.

20% fentanyl-related tariff: added as a penalty over alleged fentanyl trafficking and enforcement concerns.

China’s Tariffs on U.S. Goods

In return, China will maintain a 10% tariff on U.S. imports. A meaningful reduction from the previous peak threat of 125% or higher. While lower than prior threatened levels, these tariffs still leave many U.S. exporters facing higher costs than they did before the trade war began.

Rare Earths & Magnets Access

In a potentially market-moving development, China has agreed to supply rare earth minerals and magnets to the U.S., directly addressing a major vulnerability for key American industries such as defense, technology, and electric vehicles. The caveat here is that China put a 6-month limit on the rare-earth exports, meaning it’s up to them if they want to continue doing so every six months. China currently produces 60% of the world’s supply of rare earths and processes close to 90%. This is a major issue for the US economy and national security, so it is a massive bargaining chip for China now and in the future unless the US resolves the discrepancy.

Student Visas

The U.S. has also reversed earlier threats to revoke visas for Chinese students, ensuring continued access for Chinese nationals to American universities.

Next Steps: Final Approval

The deal still requires final sign-off from both President Trump and Chinese President Xi Jinping. However, the framework has been confirmed by both governments' commerce ministries, and implementation planning is seemingly underway.

Will this be a “win” for the US in the long run?

While this agreement represents a partial de-escalation compared to the most aggressive stages of the trade war rhetoric, the agreement still leaves a massive question yet to be answered:

Will the United States emerge from these trade wars and economic policy shifts stronger, more prosperous, and more secure than it would have been had we simply left things alone? Or will these policies ultimately leave us economically weaker, with diminished growth, higher debt, less competitiveness, and new vulnerabilities to both national security and global stability?

That answer will take a deeper dive at some point and time to allow it all to play out.

Fed Week: Expect changes to the rhetoric but not the rate. And the real "numbskulls" in the room.

It’s once again Fed Week. That time every six weeks when voting members of the Federal Reserve meet to determine the Federal Funds Rate. And once again, we can expect no change as the Fed continues to do the right thing in exercising patience, while waiting to see how Trump’s tariffs and trade war ripple through the economy as it is only just now beginning to show up in the data.

Of course, taking the correct approach didn’t stop President Trump from taking another swing at Fed Chair Jerome Powell this week, calling him a “numbskull” for having the audacity to simply do exactly what a central banker should by letting the data lead policy, not political pressure.

But let’s step back and ask: who’s the real numbskull here? The man working to prevent another dangerous wave of inflation? Or the man who hired him, while repeatedly claiming he “only hires the best,” and is now lashing out at his own appointee for having the nerve to protect him from himself?

Trump is flat-out wrong on this one. The evidence is obvious and as plain as day: commodity prices are heating up again, Treasury yields remain elevated, and inflationary pressures are far from resolved. The 2-year Treasury yield, which is the actual leading reference point for shorter-term borrowing costs, remains elevated. Powell could slash rates tomorrow, but banks aren’t going to follow him if the 2-year stays elevated. This is how credit markets function, regardless of whether politicians like it or not.

Yet Trump is now going so far as to suggest he “might have to force something” if Powell doesn’t do what he wants him to do. That isn’t leadership. It’s attempted intimidation, and it echoes the kind of behavior typically associated with unstable economies run by despots. When weak leaders refuse to do the work to understand how systems actually function, they often resort to force, because that’s all they have left to hide the policy failures of their own making.

Unfortunately, Trump wasn’t the only one showcasing economic ignorance this week. As Vice President JD Vance also added his own willful ignorant commentary, accusing the Fed of “monetary malpractice” while erroneously using this past week’s inflation reports as justification. What he failed to mention, or perhaps is too lazy to look, is that inflation actually showed signs of curling back up. But recognizing that would have required a basic understanding of the data, rather than simply following talking points and party lines.

Rush Limbaugh used to refer to certain voters as “low-information voters.” What we’re seeing now are two low-information “leaders.” Neither of whom seem to grasp that the Fed is actually doing them a favor. The greater risk at this stage isn’t that rates are too high. On the contrary, the bigger risk now is cutting prematurely and later being forced to reverse course in the coming months should inflation rates re-accelerate. Waiting offers limited-to-no downside right now because we are nowhere near a deflationary environment, despite what the economic extremist influencers who have been consistently wrong for over a decade are now claiming in order to drive engagement.

For now, the Fed will correctly hold rates steady. But I do expect them to start softening their language, signaling a more dovish tone and opening up the possibility of rate cuts in the coming months. Whether that shift sticks will depend entirely on how the data evolves as the effects of tariffs and trade wars continue to build.

Markets:

We might finally be getting that rollover in markets to set up the Summer Rally thanks in part to a “sell the news” event with the US-China trade deal and escalation in the Middle East between Israel and Iran.

$SPY ( ▼ 1.02% ) S&P 500:

If this is a rollover to set up the Summer Rally, then I am looking at ~$570ish for SPY to find support.

SPY Daily

$DIA ( ▼ 1.63% ) Dow Jones Industrial Average:

DIA Daily

DIA Weekly

$QQQ ( ▼ 1.22% ) Nasdaq:

QQQ Daily

$IWM ( ▼ 1.56% ) Russell 2000 (Small Caps):

IWM Daily

There is ALWAYS an opportunity somewhere. And typically there are many opportunities if you’re aware of what is happening and how it fits with the cycles which continue to play out throughout human history.

A couple of opportunities now in play come as a result of the increased fighting in the Middle East.

Hey, you didn’t start the conflict and you’re going to be paying for it through taxes and higher prices as a result so you might as well cushion the financial blow as best you can. And a couple of those opportunities come from the shipping and oil and gas sectors:

$SBLK ( 0.0% ) , a shipping company whose stock price could benefit by the rising shipping rates associated with a lack of shipping in the Straight of Hormuz:

$CVX ( ▲ 0.53% ) which could benefit from the higher price of oil and gas from a possible prolonged confrontation:

You may not have any say into what will happen in the world and how it will result in higher costs for you in the future, but you can minimize and even profit from the situation which was no making of your own.

Significant Economic Data from the previous week:

Actual | Expected | Previous | |

|---|---|---|---|

Core CPI (May) | 0.1% (MoM) 2.8% (YoY) | 0.3% (MoM) 2.9% (YoY) | 0.2% (MoM) 2.8% (YoY) |

CPI (May) | 0.1% (MoM) 2.4% (YoY) | 0.2% (MoM) 2.5% (YoY) | 0.2% (MoM) 2.3% (YoY) |

Core PPI (May) | 0.1% (MoM) 3.0% (YoY) | 0.3% (MoM) 3.1% (YoY) | -0.2% (MoM) (Revised higher from -0.4%) 3.2% (YoY) (Revised higher from 3.1%) |

PPI (May) | 0.1% (MoM) 2.6% (YoY) | 0.2% (MoM) 2.6% (YoY) | -0.2% (MoM) (Revised higher from -0.5%) 2.5% (YoY) (Revised higher from 2.4%) |

Economic Data to watch this week:

Date and Time | Expected | Previous | |

|---|---|---|---|

Core Retail Sales (MoM) (May) | Tues, June 17th @ 8:30a EST | 0.3% (MoM) 2.9% (YoY) | 0.1% (MoM) 2.8% (YoY) |

Retail Sales (May) | Tues, June 17th @ 8:30a EST | 0.1% (MoM) (YoY) | 0.1% (MoM) 5.16% (YoY) |

Housing Starts (May) | Wed, June 18th @ 8:30a EST | 1.360M (May) % (MoM) | 1.361M (May) 1.6% (MoM) |

Fed Interest Rate Decision | Wed, June 18th @ 2p EST | 4.25% - 4.5% | 4.25% - 4.5% |

Quote of the Week:

“You have 3 choices in life:

Give up,

Give in,

Or give it your all!

WOOOOOO!”

Click the Leave a comment button if you have any questions or comments, or need something clarified. Don’t be shy. The main point here is to improve constantly. Questions and comments help us both and tells me what you are interested in learning/hearing more about.

If you enjoyed this post or found it useful, do me a favor and hit the like (heart button all the way back to the top of the post and to the left) and share it with others.

Reply