- The Economy Tracker

- Posts

- Understanding Secular Markets

Understanding Secular Markets

The Lesson I Learned the Hard Way

I'll never forget watching this guy on TV in 2010, thinking he was absolutely insane.

We were still recovering from the 2008 financial crisis. The wounds still open and raw, not the faded scars they are today. And here's this person claiming the Dow would hit 38,000 by 2025. At the time, it was around 10,500. He was predicting a 260% increase over fifteen years.

"What an idiot!" I thought as I shook my head and rolled my eyes.

I was convinced 2008 was just the first wave, that another crash was inevitable. Turns out there was an idiot in that situation, but it wasn't him. It was me.

The Dow hit 38,000 in January 2024. As of this writing it is over 48,000.

What he understood, and I didn't at the time, was secular markets.

Why This Matters Now

I keep talking about how "we appear to be morphing from a Secular Bull into a Secular Bear" market, so let me explain what that actually means. Here's what it doesn't mean: a prolonged recession or depression. The US economy will still grow, and there will continue to be incredible investing and trading opportunities. Just not in the same areas that have dominated the past 15 years.

Understanding secular markets can transform your investing. Let me show you how.

What Is a Secular Market?

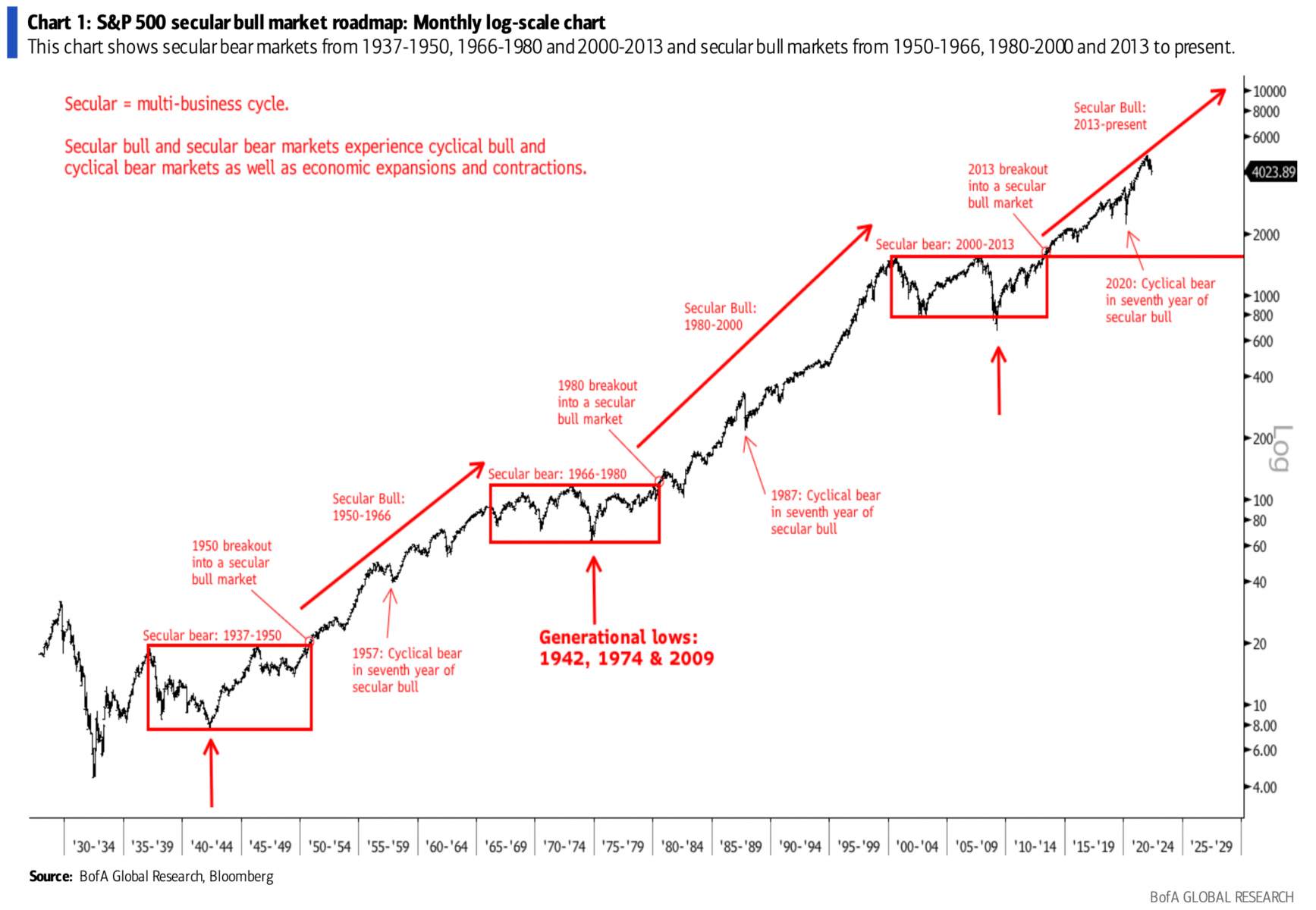

A secular market is a long-term trend lasting 10 to 20 years, driven by powerful, persistent forces that shape the fundamental direction of prices. These are structural shifts in the economy, technology, or society itself; Not your typical cyclical or seasonal ups and downs.

Think of the US equity market from 1982-2000, or 2013-present: these are secular bull markets. The late 1960s through early 1980s, and 2000-2013 were secular bear markets.

Here's the key insight: During secular bulls, stock market indices trend up and move much higher. During secular bears, they consolidate and move sideways. But, and this is crucial, sideways doesn't mean that no investing gains are available. It means the best stock gains shift elsewhere.

The Tale of Two Markets

Secular Bull Markets feature:

Lower interest rates and inflation

Technological innovation driving growth

Strong corporate earnings and profit margins

Less global conflict

US markets outperforming non-US and emerging markets

Technology stocks leading the way

Abundant investment capital

More open and free trade policies around the globe

The most forgiving environment for business risk-taking

The longer it lasts, the more feverish speculation gets as it repeatedly pays off

Secular Bear Markets feature:

Higher interest rates and inflation

More global conflict

Economic stagnation with weaker earnings and profit margins

Emerging markets and non-US markets outperforming the US

Less open trading between countries and more protectionist policies

"Dirty" sectors (commodities, energy, industrials) lead the way

Technology stocks underperforming (“Tech is dead.”)

Important: "Secular bear market" doesn't mean stocks don't gain. That's a myth spread by people who only know how to invest in what worked the previous decade or only look at the indices ($SPY ( ▲ 0.23% ) $DIA ( ▲ 0.24% ) $QQQ ( ▼ 0.01% ) $IWM ( ▲ 0.38% ) ). These are long-term periods of consolidation for US indices, but they offer tremendous opportunities elsewhere.

How It Feels in the Real World

The shift between these market types isn't just about stock prices, it changes everything about the economy and how people live.

Economic Growth and Jobs

During secular bulls, GDP growth runs above trend with sustained expansions. Unemployment stays lower and more stable. Labor markets stay tight, forcing companies to compete for workers with higher wages.

During secular bears, GDP growth slows and gets interrupted more frequently by recessions. Unemployment averages higher and swings more wildly. Wage growth stagnates, and real wage gains become rare.

Consumer Behavior

This is where you really see the difference play out.

In secular bulls, consumers feel confident. They buy homes, cars, and luxury items. They take on debt willingly. Asset values rise, creating a wealth effect that fuels more spending. Discretionary purchases (travel, entertainment, high-ticket items) surge .

In secular bears, consumers eventually turn cautious. They focus on essentials, prioritize savings, and postpone major purchases. Discretionary spending drops. People hunt for bargains and cut back on non-essentials. Any spending increases tend to be temporary, often triggered by government intervention.

The Four-Phase Cycle We're Living Through

Here's where the major investing themes of “buy picks and shovels” and 10 year timelines for mass adoption of new technologies discussed at Stocktoberfest, fits perfectly into my thesis that we're morphing out of a secular bull and into a secular bear.

This pattern has played out throughout history with railroads, financial services, computers, and the internet. And it's playing out now with AI and blockchain.

Phase 1 – The Gold Rush Money floods new sectors as speculation picks up steam and becomes rampant. Fueled by a decade-plus bull market which has most investors and traders feeling like geniuses.

Phase 2 – The Crash Markets collapse as the credit cycle ends. Speculative growth stocks get crushed. Fortunes evaporate.

Phase 3 – The Mockery New technologies become punchlines to the masses. "Remember when people thought that would change the world?" Meanwhile, real companies quietly attract capital and continue to build while frauds and companies which can’t execute die off. Strong operators end up consuming weakened competitors.

Phase 4 – The Rise Just when everyone's given up and when these technologies seem like pipe dreams for everyday life, the survivors emerge and eventually become the world's most valuable companies.

Think Facebook, Google, and Netflix in the 2000s.

We're in Phases 1 right now for AI, blockchain, and tokenization. That’s why "picks and shovels" in these sectors is the place to be in the coming years as they get built out and consolidate.

What I'm Watching Now

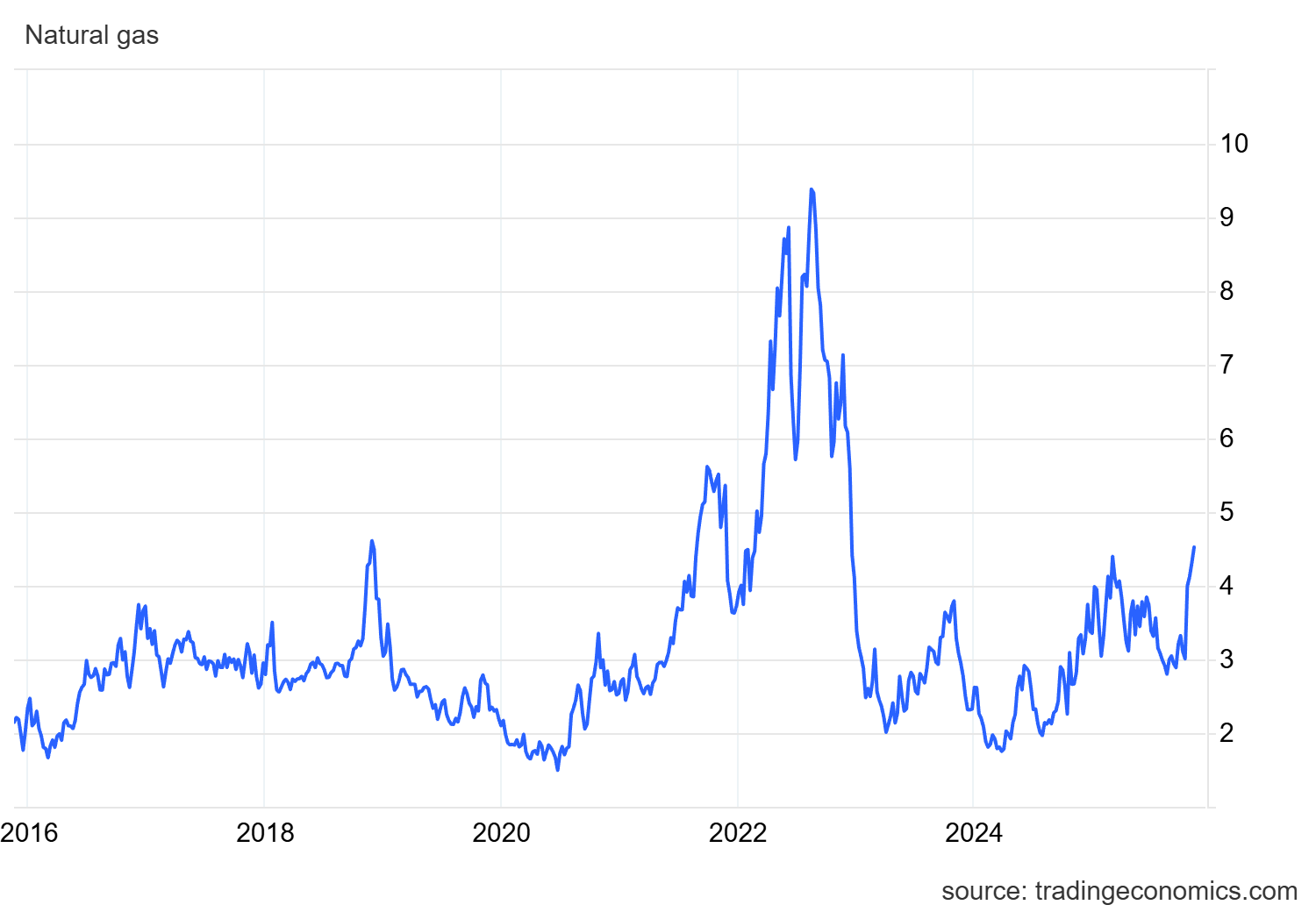

I'm seeing the shift happen in real-time. Energy companies and commodities are breaking out of decade-long consolidation patterns, positioning for significant moves over the next 5-10 years.

This is why gold has raged higher over the past year-and-a-half.

The biggest opportunity I see right now? Natural gas.

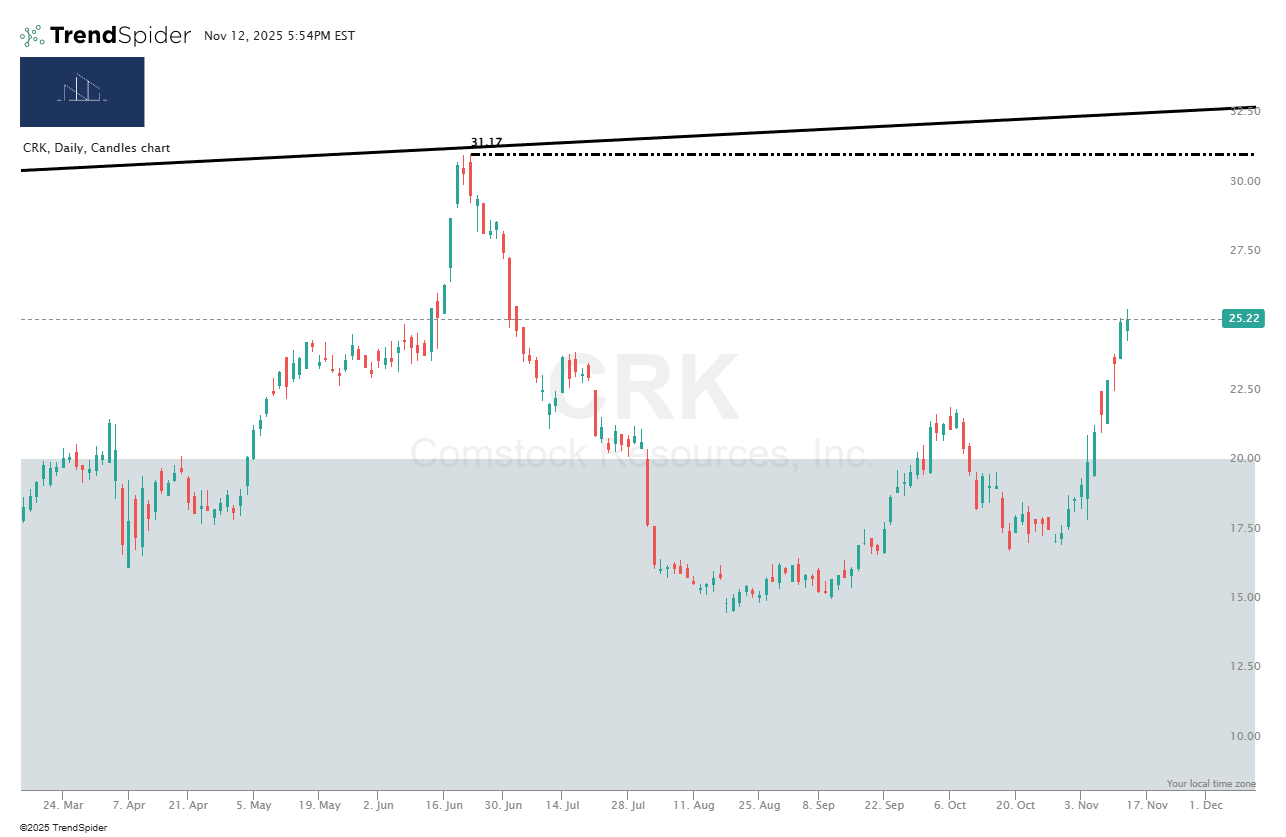

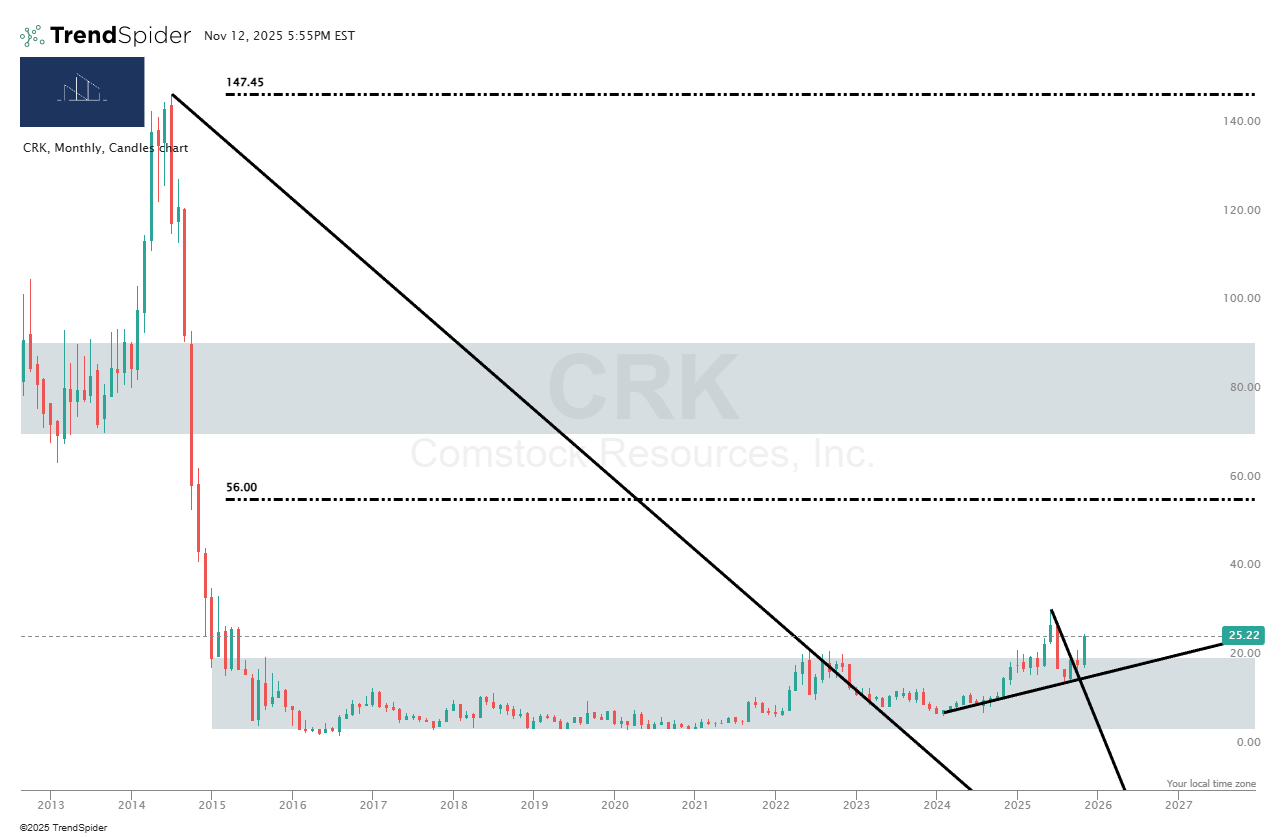

Which is why I called out $CRK ( ▼ 2.26% ) a week-and-a-half ago, as it was confirming the break out of a decade long base. Since then, it’s up over 30%.

CRK - Daily Chart

CRK - Monthly Chart

Definitely one of my favorites for the next 5-10 years.

Here's the thing most people miss: Natural gas is as much an AI play as META, GOOGL, or MSFT. Think of those tech giants as the vehicle, but every vehicle needs fuel. Natural gas is the bridge meeting AI's surging energy demands until nuclear power scales up, which is a 5-10 year timeline.

About That Guy Who Made the Dow 38K Call on TV

His name is Jeff Hirsch, and he runs Stock Trader's Almanac. A 57-year-old publication his father Yale started in 1968. Yes, that Stock Trader's Almanac I've recommended numerous times.

I have fully moved from cynic to disciple of Jeff’s work, which is why I highlight his analysis so often. When I speak about Secular Markets and the Four Year Presidential Cycle, those are concepts I learned from Jeff Hirsch and Stock Trader’s Almanac. Learning these two concepts played a major roll in my ability to see and understand markets. If you take the time to learn and understand the basics of these concepts, you will have a HUGE advantage as an investor and/or trader.

Ironically, my Econ 101 professor introduced me to their work on the four-year presidential cycle almost 25 years ago. I didn't fully grasp it then. I definitely didn't understand secular markets 15 years ago when I saw Jeff on TV. But now? Both concepts form major pillars of my analysis.

Jeff is one of the very best. He's taken his father's incredible legacy and made it even better while expanding its reach. A truly remarkable achievement.

I recommend starting with his book The Little Book of Stock Market Cycles and the annual Stock Trader's Almanac for 2026. Both have sharpened how I see markets. And maybe they'll help you avoid calling the next person with a bold prediction based on historical cycles an idiot, like I did.

Click the Leave a comment button if you have any questions or comments, or need something clarified. Don’t be shy. The main point here is to improve constantly. Questions and comments help us both and tells me what you are interested in learning/hearing more about.

If you enjoyed this post or found it useful, do me a favor and hit the like (heart button all the way back to the top of the post and to the left) and share it with others.

Reply