- The Economy Tracker

- Posts

- Here's the Deal

Here's the Deal

December 1, 2025

This week’s newsletter brings together two powerful truths about the moment we’re living in: the AI era is accelerating faster than most people realize, and the physical and financial systems supporting it are already showing signs of strain. From ChatGPT’s third birthday marking three years of economic reshaping, to a real-world data center failure that froze global futures trading, we’re seeing both the promise and pressure of this technological shift play out in real time.

At the same time, markets continue to march higher, breaking through major resistance zones right as seasonal tailwinds kick in. Breadth is healthier than the skeptics claim, leadership is rotating, and several sectors tied to a classic flight-to-safety posture are waking up. And while AI keeps pulling capital into high-density infrastructure, not every asset is participating as Bitcoin’s ongoing weakness is telling a very different story beneath the surface.

All of it points to one thing: we’re entering a phase where understanding both the opportunities and the constraints behind AI, markets, and infrastructure will matter more than ever.

Let’s break it down.

Happy Birthday to ChatGPT—and the AI Era

ChatGPT launched on November 30, 2022, as a free research preview from OpenAI. That release, powered by GPT-3.5, sparked the modern AI boom. Three years later, the economic and market effects have been profound, though unevenly distributed.

On the economic side, AI has accelerated productivity gains in knowledge work: writing, data analysis, design. Some estimates suggest AI could add trillions to U.S. GDP within a decade. But the gains haven't been shared equally. We're seeing a K-shaped pattern where tech firms and high-skill workers thrive while others face displacement risk, particularly in creative and analytical roles.

In markets, ChatGPT's arrival helped end the 2022 bear market. AI investment has been the catalyst and fuel for the current bull run in U.S. equities. While the rally concentration has been erroneously castigated as top-heavy and limited to the Mag-7, a simple count of 52-week highs and performance results of the majority of stocks the past three years tells a story of broad participation.

Pro tip: Be cautious of anyone insisting that “only the Mag-7 is going up.” That narrative is almost always misleading. In most cases, it comes from people who missed the broader opportunities and try to dismiss what’s actually happening in the market to protect their own egos.

Breadth has expanded, leadership is rotated, and multiple sectors are showed strength over the past three years. When someone insists the rally is narrow, it usually says more about their positioning and lack of understanding than it does about the market.

CME Data Center Outage: A Case Study in Infrastructure Fragility

Last week offered a sharp reminder that the AI era rests on physical systems that are under growing strain.

On Thursday night into Friday (November 27–28), CME's Globex platform went dark. For roughly 10–11 hours, trading halted across futures and options in equities, Treasuries, FX, commodities, and some crypto derivatives. Brokers and clients were "flying blind" during a thin post-Thanksgiving session, with some firms forced to rely on internal pricing.

The surprising part? The outage wasn’t caused by a cyberattack or a faulty software deployment. It came from something far more mundane; a cooling system failure at CyrusOne’s CHI1 data center in the Chicago region. As the building overheated, an emergency shutdown was triggered to protect the hardware. Engineers then had to restart chillers at reduced capacity and wheel in temporary cooling equipment before systems could be brought back online, step by step.

Why This Matters Beyond One Bad Day

The outage exposed several uncomfortable truths about modern financial infrastructure.

1. Concentration risk.

A single privately owned data center experienced a cooling failure, and global futures trading froze. This happened despite supposedly redundant architectures. In practice, those protections didn’t hold up under real stress.

2. AI is pushing these systems past their design limits, accelerating the problem.

High-performance compute and AI workloads dramatically increase power density and heat output. Many legacy cooling systems simply weren’t built for this intensity. As AI ramps up, traditional data centers are becoming more failure-prone, not less.

3. Failover and disaster-recovery plans still have gaps.

CME chose to restart operations in Aurora rather than “failover” to its backup site in New York. That decision raises questions:

When do failover triggers activate?

How “live-ready” are secondary sites, in reality?

Are Disaster Recpvery protocols being tested under realistic load conditions?

The AI boom is accelerating the stress on physical infrastructure. Last week showed what happens when the hardware behind financial markets, and behind AI itself, starts to buckle.

Chemours $CC ( ▲ 0.78% ): A Picks-and-Shovels Play on the Cooling Problem

If the CME outage illustrates the problem, Chemours is positioning itself as part of the solution.

The company is developing “Opteon-branded” dielectric fluids for next-generation data center cooling, specifically two-phase immersion and direct-to-chip systems. Think of it as the specialized "blood" that can flow through high-density AI infrastructure to carry heat away far more efficiently than air ever could.

The performance claims are significant:

up to 90% lower cooling energy consumption,

40% lower total cost of ownership,

60% smaller facility footprint, and

near-elimination of water usage.

These fluids also support heat recovery and can be reused, helping operators meet circularity and sustainability goals.

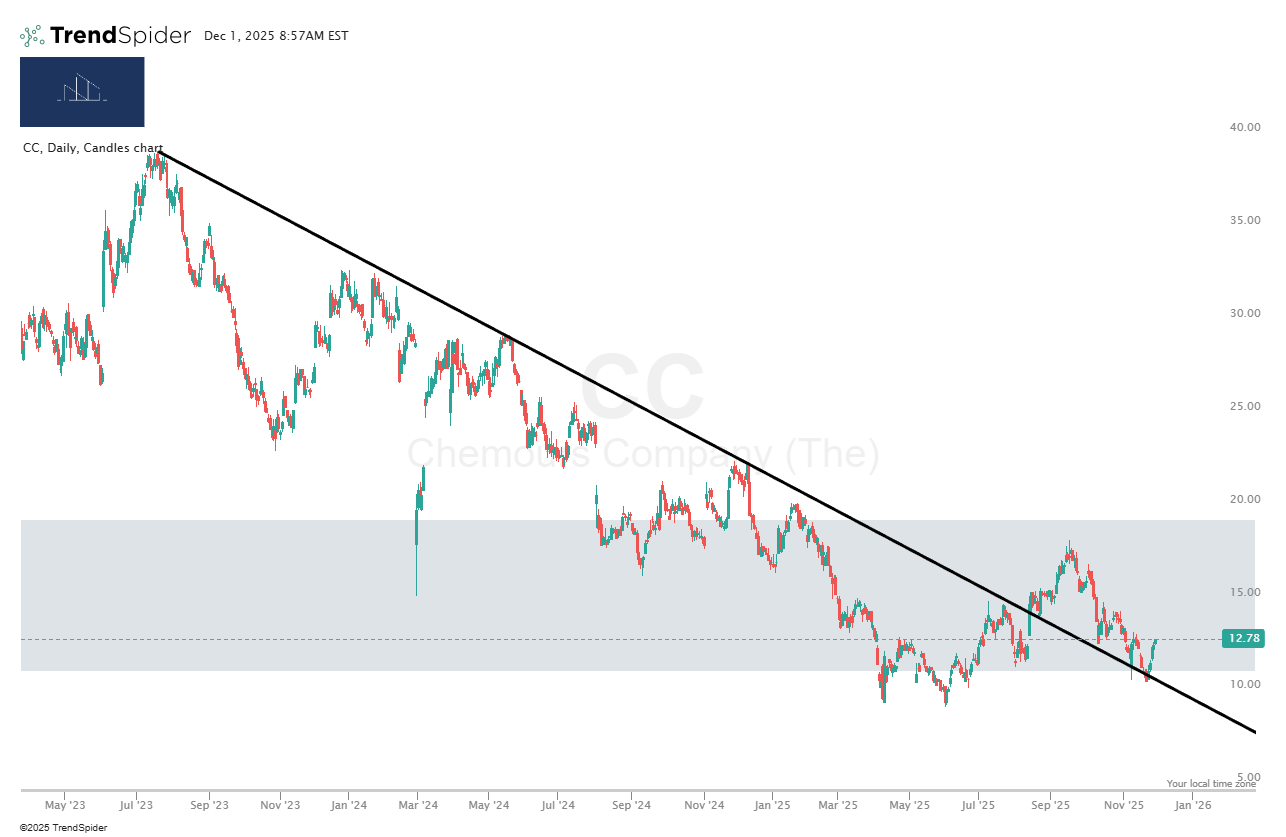

CC - Daily Chart

Chemours is building an ecosystem around these products. They've partnered with DataVolt to demonstrate scalable AI-focused data centers, and their fluids have been qualified by major OEMs like Samsung. This qualification process creates switching costs and potential lock-in as adoption scales.

The company's competitive advantage stems from its deep fluorochemicals expertise. Opteon fluids carry a global warming potential of roughly 10, dramatically lower than older PFAS-based coolants. That positions Chemours ahead of tightening environmental regulations and gives operators a long-term compliance advantage.

The Investment Thesis

As AI raises power demand and heat density, data center operators face binding constraints on energy, water, and zoning. Chemours' fluids directly address these constraints, making high-density liquid cooling more efficient and regulatory-compliant.

If two-phase immersion and direct-to-chip cooling become standard for AI and high-performance computing, demand for specialized dielectric fluids should scale with global data center capital expenditure and not with any single operator's fortunes.

That's a "picks and shovels" investment: Chemours wins as the infrastructure buildout continues, regardless of which AI companies ultimately dominate.

Markets:

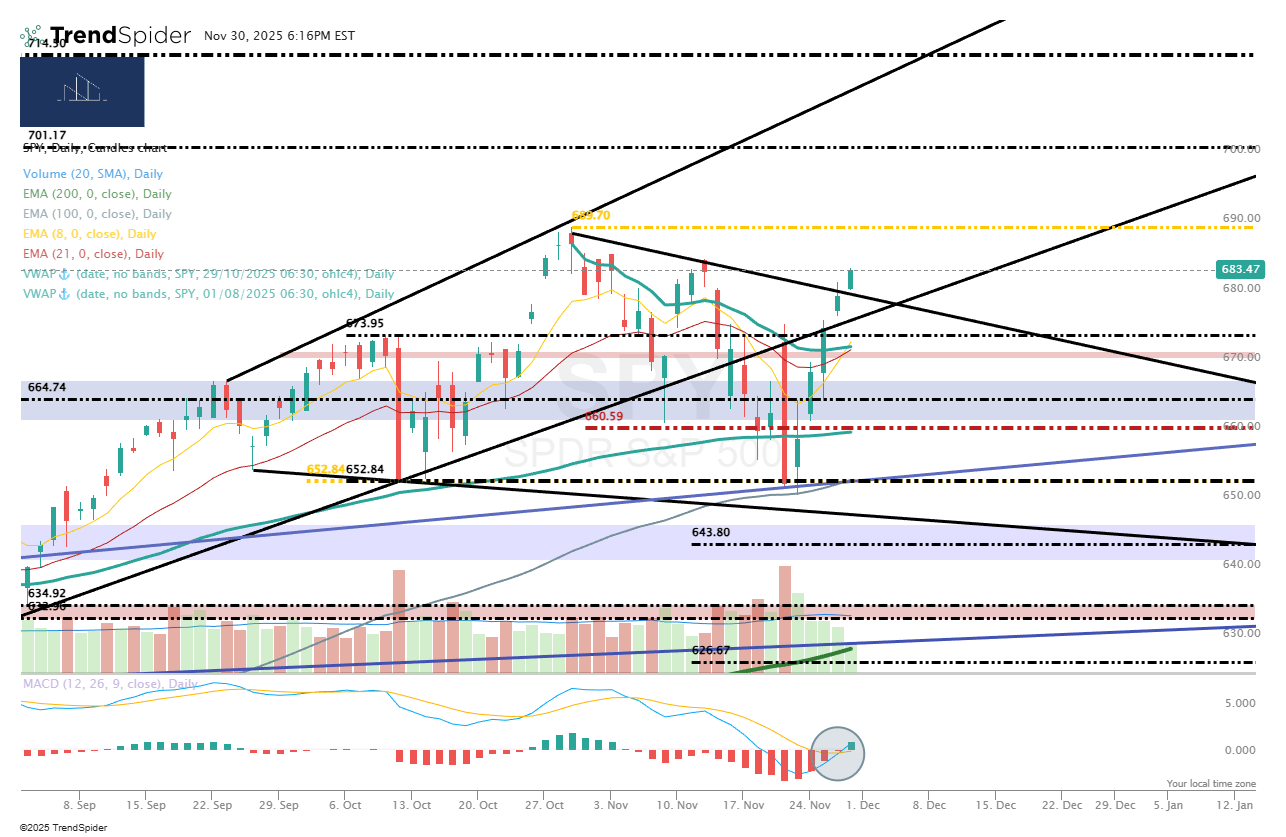

Markets kicked back into gear during the shortened week, powering cleanly through the $670–$675 resistance zone in SPY.

$SPY ( ▲ 0.16% ) S&P 500

SPY Daily

That’s exactly what you want to see if you’re looking for new highs into year-end and potentially into early next year. Strength on a retest followed by decisive follow-through is the hallmark of a market with momentum behind it.

On top of that, the MACD Crossover signal for the “Best Six Months” strategy finally triggered this past week.

For context, the Stock Trader’s Almanac tracks a long-standing seasonal approach known as the Six-Month Switching Strategy, which works like this:

Buy QQQ when MACD turns positive after October 1.

Sell QQQ when MACD turns negative after May 1.

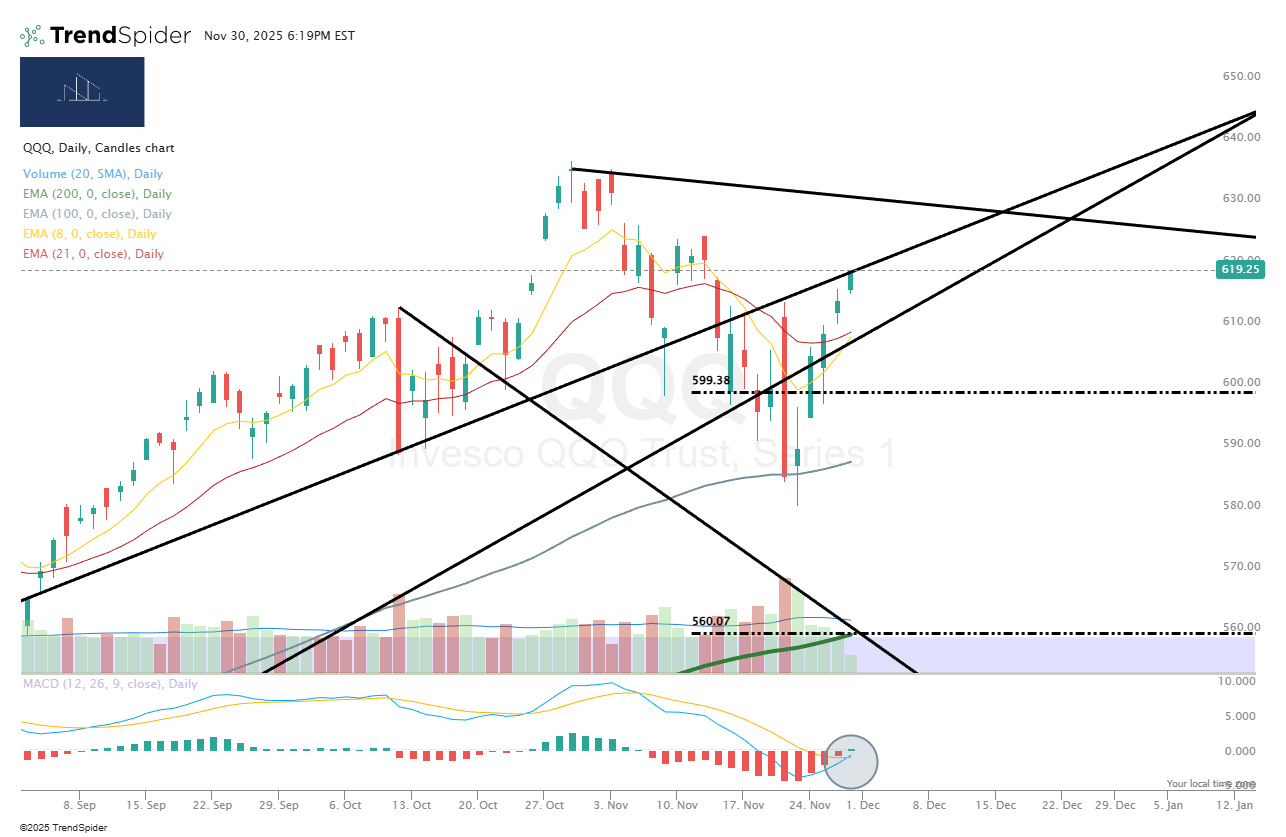

$QQQ ( ▼ 0.1% ) Nasdaq:

QQQ Daily

It’s a simple, rules-based strategy designed for traders or investors who prefer not to manage positions actively year-round. Importantly, the buy signal activated this past week,, officially kicking off the seasonal tailwind.

Why does this matter? Historically, the November–April period, referred to as The Best Six Months, dramatically outperforms the rest of the year. When you combine that seasonality with a technical breakout through major resistance, you get a market setup that deserves attention.

Put it all together, and the stars are aligned for what could be an explosive final month of market action in 2025.

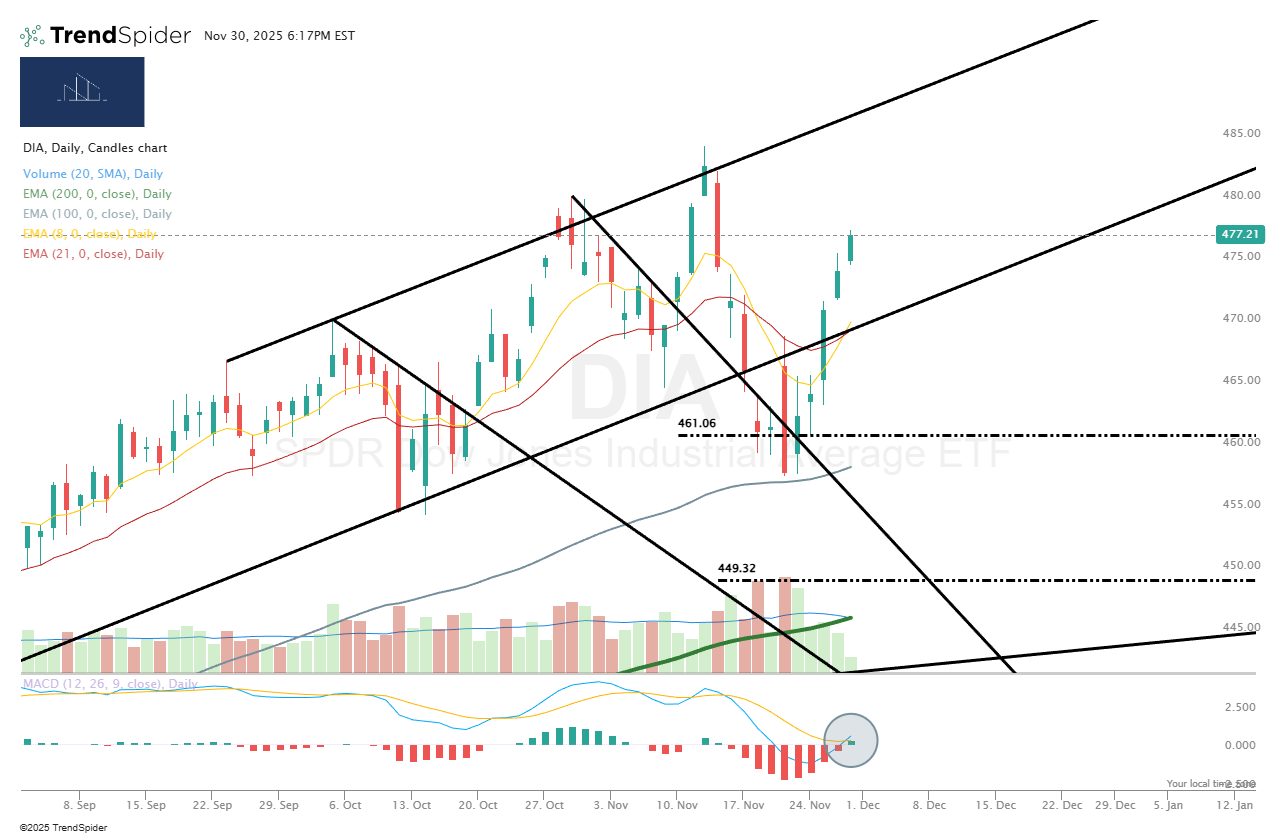

$DIA ( ▲ 0.12% ) Dow Jones Industrial Average:

DIA Daily

$IWM ( ▲ 0.03% ) Russell 2000 (Small Caps):

IWM Daily

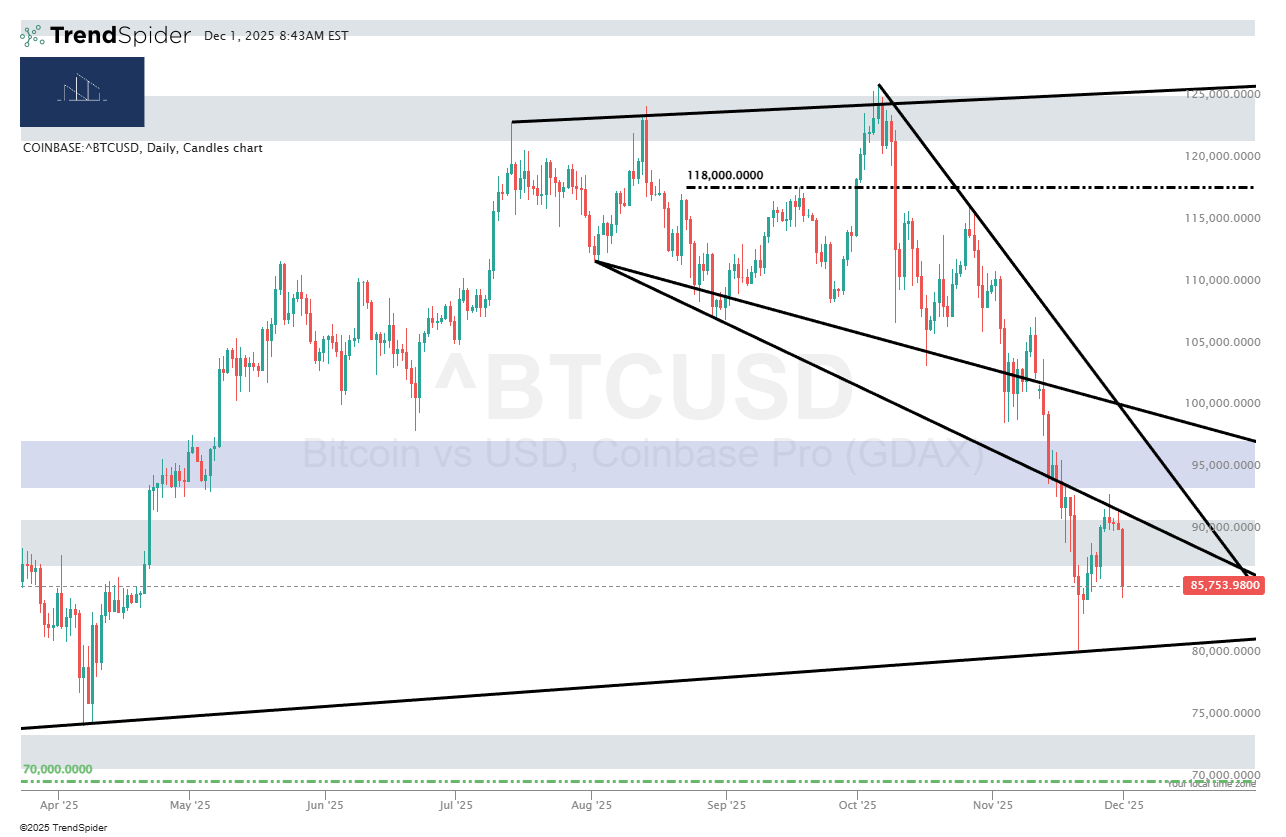

But keep an eye on Bitcoin $BTC.X ( ▼ 2.04% )

While precious metals are ripping higher, Bitcoin continues to behave like a stone-cold loser. The fact that this weakness is happening at the same time the broader market is showing a strong recovery is an important tell. It suggests Bitcoin is acting more like a Secular Bull Market asset, something that thrives in periods of broad economic expansion rather than a safe haven during the coming Secular Bear.

We’re beginning to see a possible classic flight to safety take shape. Precious metals, Healthcare, and Utilities are showing relative strength. Consumer Staples may now be beginning to show emerging relative strength as well. Meanwhile, Bitcoin has continued to break down, signaling that it’s not where capital seeks shelter during uncertain periods. Instead, it is proving to be where capital flees from.

Bitcoin’s inability to hold any meaningful upward momentum is another warning sign. In risk-on environments, Bitcoin has acted as a leader. When it weakens despite strong equity performance, it can reflect a deeper risk-off tone developing beneath the surface.

As I mentioned last week: the writing may be on the wall.

Crypto could easily become a dead money for the next 5–10 years, especially if this Secular Bear Market continues to unfold.

Bitcoin - Daily Chart

WTF of the Week:

Quote of the Week:

“Bitcoin is like anything else: it's worth what people are willing to pay for it.”

Click the Leave a comment button if you have any questions or comments, or need something clarified. Don’t be shy. The main point here is to improve constantly. Questions and comments help us both and tells me what you are interested in learning/hearing more about.

If you enjoyed this post or found it useful, do me a favor and hit the like (heart button all the way back to the top of the post and to the left) and share it with others.

Reply